I'm late 40's, planning to hit the eject button in 2015 which will give me about $75K per year in retirement just for being alive, not bad for a mouth breathing neanderthal .

Married (wife 1.0), 1 kid (1st Grade), transferred GI bill four years ago (fully vested), 529 currently has $138,000, will hit the $235K limit well before 18.

No debt other than one mortgage (30 year 3.5%, with $275,000 to go) and a car payment (1.4% on a remaining balance of $25,000)

Owned first house since 1991, bought another in 1997, and current one since 2006. Never carried any credit card debt, have a libor loan pledged from my porfolio for large purchases that is basically a large line of credit @ 1%.

Net worth = Doing ok

1.6M in taxable brokerage account (Current distro = .01% cash, 9.83% in MMF and BDP, 72% in Stocks/Options ,18.16% in Mutual Funds)

180,000 TSP

360,000 Roth IRA

300,000 Wife's Roth

187,000 Traditional IRA

120,000 Wife's Traditional IRA

138,000 529 college savings plan

50,000 Cash Savings Checking, Savings, MM, and a CD)

250,000 equity in Rental Property #1 (No mortgage) - Generates $1500 @ month in income.

175,000 equity in Rental Property #2 (No mortgage) - Generates $1300 @ month in income.

75,000 equity in Rental Property #3 (30 year 3.5%, with $275,000 to go) break even each month, win overall based on tax deductions.

50,000 equity in land (No mortgage) - Sitting idle and have to pay Prop tax and HOA fee, want to sell it.

500,000 equity in another piece of land (Inherited from grandparents - No mortgage - lease to a farmer for agricultural tax exemption)

I max out my Roth IRAs and TSP every year.

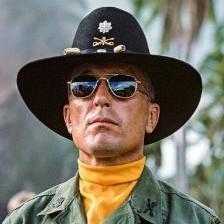

As a Capt who flew mostly at night, I spent some time as a daytrader...did very well AND very bad, lost $35K one day, made $40K on another. Got very nervous at one point when I realized I had over $100K on margin, so I quit. Luckily on the advice of a friend I got in early on SanDisk and held it long through a couple splits, made a LOT of $ when I sold it, paid off two houses, paid a metric shit ton in taxes (my tax liability that year was more than my entire AF salary), and gave the rest to a professional wealth manger who has since tripled what I gave him.

.thumb.jpg.9c390ca8e6e624c0547abd6a3f6885b5.jpg)