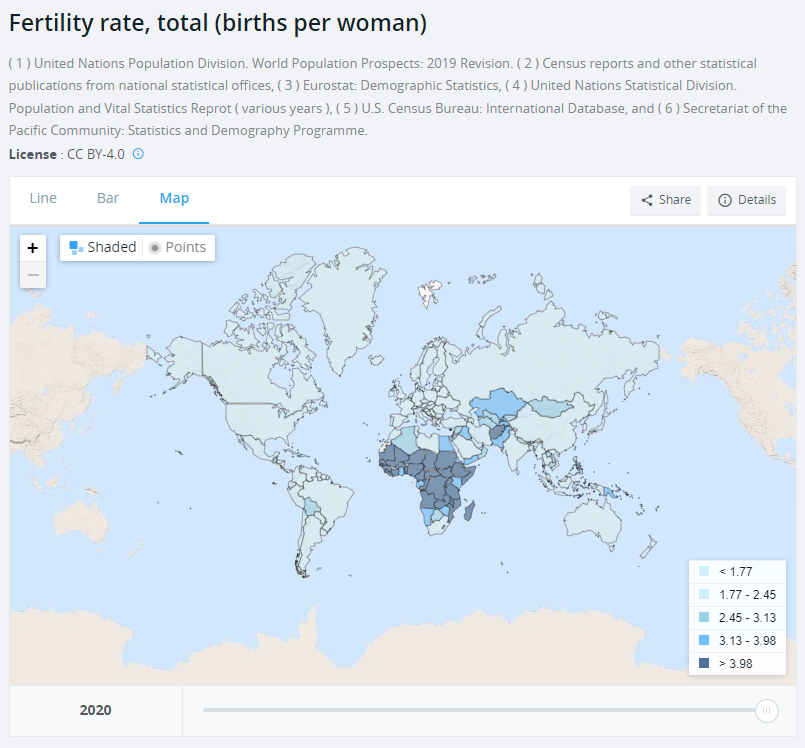

The birth rate in the US and the EU are approximately equal (1.6 vs 1.5), and the birth rate globally is mostly below replacement rate. The only place that doesn't hold is where birth control is not widely available, which is Africa.

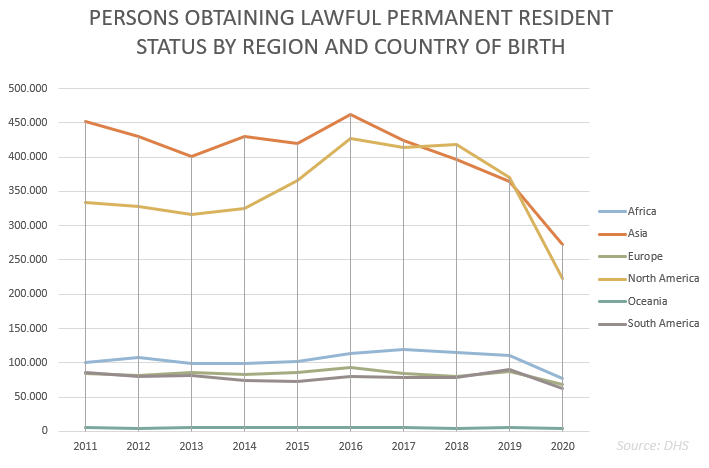

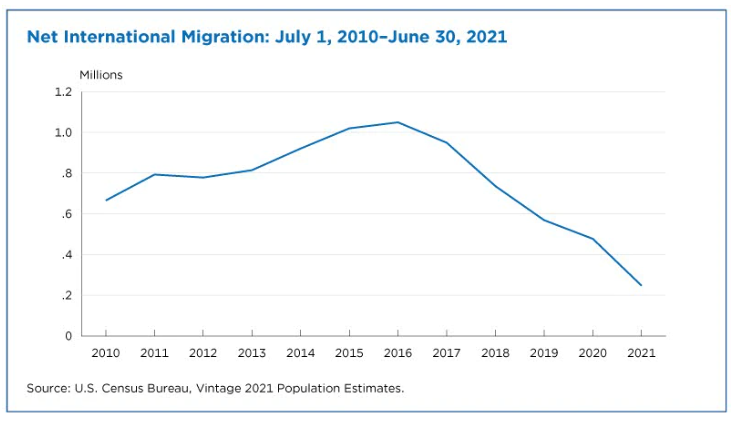

So in general, assuming developed countries want to continue to provide the same amount of goods and services to a nearly constant population over the next 20 to 50 years, they have to import some workers from Africa and other undeveloped regions. Hence why the EU accepted an influx of migrants from the ME & NA, despite the risks involved. However, immigration to the US is decreasing as well, as incomes & quality of life are no longer sufficiently higher there than in other parts of the so-called 'global south'. That is, prices of critical goods and services are too high to draw migrants or for households to have larger families.

All this means is that the total share of income going to households is too low, or conversely, the share of total income going to the financial (banks, NBFIs) and non-financial sector (firms) is too high. This is a well know fact, and one of the reasons why the US recently implemented a subsidy for families with children, an acknowledgement that the current economic system generates an insufficient amount of bargaining power for domestic workers resulting in wages that are too low and overly reliant on credit (and hence interest rate conditions) to finance living.

But the statements made that China will implode based on these conditions applies to all developed states, in that context, as all are experiencing the exact same thing: an inability to maintain a workforce that produces the current level of output using just the domestic population.

But what's not being discussed is that given stagnating or decreasing population levels in all developed states, fewer total goods and services are required to sustain the population. We don't need more stuff. In that case, the problem isn't one of insufficient goods & services available for households leading to an implosion of the state. The problem is that the total capacity to produce goods and services is larger than the population it serves, which means owners of Capital (machines, factories, and methods of producing things) and owners of the corresponding financial assets (capital) face decreasing prices and lower monetary values for this wealth. This is known as a 'general glut' in economic parlance, one where the 'captains of industry (& their bankers finance)' are desperate for the prices of everything not to collapse.

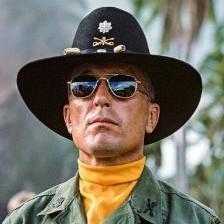

(1).thumb.jpg.7759999c13b3f642753de813ad11dd09.jpg)