-

Posts

394 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Gallery

Blogs

Downloads

Wiki

Everything posted by MilitaryToFinance

-

Maybe other people knew this but I just found out today that with a VA Loan you are required to use an escrow for your taxes and insurance. I've been getting annoyed with my bank constantly changing the escrow amounts and I would much rather just pay my bills myself. So I called to try and switch and they said government loans won't let you, the escrow is a requirement. Just a random annoyance I didn't know about for anybody shopping VA loans.

-

Exhibit 2: Sebastian Vettel pre & post Red Bull. As much as I can't stand Hamilton he is a phenomenal driver. Even with the equipment advantage it's hard to argue with some of his come-from-behind results going from 15+ on the grid to winning.

-

The best driver in Formula 1 turns 40 today.

-

-

Investment showdown -- beyond the Roth, SDP, & TSP

MilitaryToFinance replied to Swizzle's topic in Squadron Bar

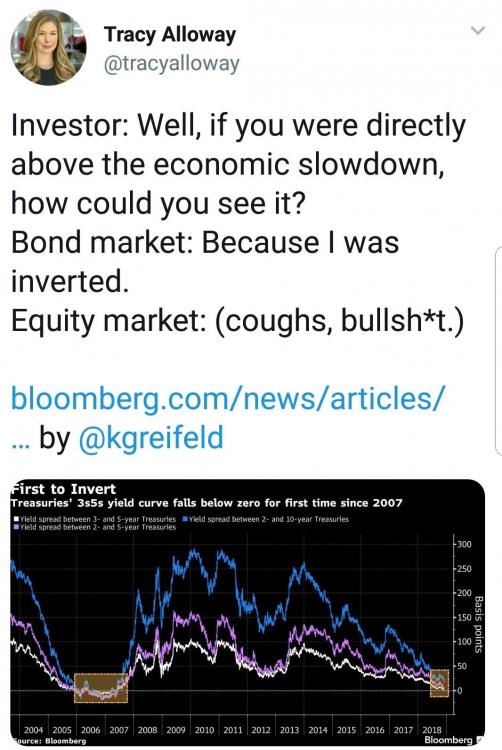

People I know have used Fundrise and one other and been happy. But it's all bull market investing so far and I tend to be skeptical. There are lots of professionals in real estate, there are lots of banks and non-bank lenders with money they will lend against quality projects. I don't see how there isn't a massive adverse selection problem with these crowdfunding systems. If the real estate was really that attractive why do they need to crowdsource it? It's not like this is a niche area of the market where traditional lenders won't lend money so you have to get creative. There is a multi-hundred billion dollar industry built around real estate development, renovating, leasing. I want to see how well all the rosy projections from these companies survive the next recession. If you wanted to sell me on crowdfunding in 2009 when nobody wanted to lend to anybody for anything it might be a different story but with $17 Trillion of negative yielding debt around the world you have a tough time convincing me that in today's market getting funding is holding back any sort of capital investment plan.- 1,204 replies

-

- 1

-

-

- sdp

- weekly trading

- (and 8 more)

-

Walmart no longer allowing open carry in stores and giving in to the whiny liberals and discontinuing the sale of handgun ammunition. Clearly the corporate culture has drifted a long ways from Arkansas. https://www.cnbc.com/2019/09/03/the-full-memo-from-walmarts-ceo-about-pulling-back-on-gun-sales.html

-

Investment showdown -- beyond the Roth, SDP, & TSP

MilitaryToFinance replied to Swizzle's topic in Squadron Bar

Check your state as well, some states (NY and CA I know for sure) tax all capital gains as income. So you get nailed for the full state tax rate on top of your federal capital gains taxes.- 1,204 replies

-

- sdp

- weekly trading

- (and 8 more)

-

Wow sounds like you had the exact opposite experience to me with NBKC last year. I always meant to write a review but never got around to it. Lots of issues around closing and something like $6,000 in fees to extend our rate lock. Some of the details have faded from my memory but I would definitely not use them again or recommend them to others.

-

Investment showdown -- beyond the Roth, SDP, & TSP

MilitaryToFinance replied to Swizzle's topic in Squadron Bar

The fact that I still own them and haven't sold tells you that I think it is not a bad trade. It just scares me when I see people going all in like this is some sure thing. Throw 1% of your portfolio at it, if it works out you make a decent bump uncorrelated to the rest of the market but if they never leave conservatorship and trade down to $0 you haven't lost much.- 1,204 replies

-

- sdp

- weekly trading

- (and 8 more)

-

Investment showdown -- beyond the Roth, SDP, & TSP

MilitaryToFinance replied to Swizzle's topic in Squadron Bar

I personally have owned Fannie and Freddie preferreds since early 2015 when they were trading for $4 on a $25 par value. At $12 today the risk/reward ratio doesn’t look as great since you can only make 2x. I got involved expecting favorable outcomes in the courts which didn’t happen. Then Trump got elected and they got a second path to paying out. All of that is context to say that even though I like the idea in some ways I don’t like buying the common stock as a hail mary/get rich quick scheme. If you want a good investing forum with smarter people, check out Corner of Berkshire and Fairfax. They have a thread on FNMA/FMCC that is 1,258 pages long dating back to January 2011 (https://www.cornerofberkshireandfairfax.ca/forum/general-discussion/fnma-and-fmcc-preferreds-in-search-of-the-elusive-10-bagger/). While the Trump administration is the first big proponent wanting to move this forward it is not a new idea. I could give lots of reasons why I’m not sure this will really work out but at the end of the day it comes down to motivation. Right now the government is in a great position, these companies throw off lots of cash and it all goes directly to the Treasury. If you privatize them again the big winners will be a bunch of hedge fund assholes like me. Of course Mnuchin supports that but who else in government is going to stick their neck out to force through a massive change on something most people don’t see as being a problem in order to benefit Bill Ackman and Bruce Berkowitz? I hope I'm wrong because the government overstepped their authority by nationalizing these business a decade ago, stealing billions of dollars from the private citizens who owned them in the process, and I would like to believe we are better than Venezuela. But I'm also not holding my breath and it's combined about 1% of my portfolio.- 1,204 replies

-

- 1

-

-

- sdp

- weekly trading

- (and 8 more)

-

If you thought chemtrails were just a government conspiracy in mind control wait until your eyes are opened to the truth!

-

Investment showdown -- beyond the Roth, SDP, & TSP

MilitaryToFinance replied to Swizzle's topic in Squadron Bar

- 1,204 replies

-

- sdp

- weekly trading

- (and 8 more)

-

https://www.reuters.com/article/us-fedex-pilot-shortage/ahead-of-holidays-fedex-leans-on-special-bonuses-to-keep-pilots-from-retiring-idUSKCN1ME0C8

-

What really matters is inflation expectations. The Fed controls short term interest rates and mortgages rates are really determined by long bonds (since your mortgage will be 15 or 30 years). The two are related and the Fed raising rates has moved up the 10 year Treasury yields and mortgage rates but it is important to remember that the Fed Funds Rate only indirectly moves those longer dated bonds. If people continue to believe that the Fed can handle inflation and keep it at or near their 2% target then long term bonds will have a natural cap. To put it into numbers, at the lows in 2016 for the year the average 30 year mortgage was 3.65% interest, last year was 3.99%, and right now is running ~4.55%. In 2011 the average rate was 4.45% and everybody thought they were getting the deal of a lifetime, mortgage rates were higher than today every year in history prior to 2011. So yes, compared to the absolute nadir of interest rates in history we are more expensive today. But in larger terms, rates are still pretty damn low. If you have a $500,000 mortgage the increase from 3.65% to 4.55% is a $261/month more in payment, not nothing but not huge either.

-

This is not as applicable to people in the military, and especially not military pilots who fly through combat zones frequently. Between your BAH, TDY pay, and any months with combat zone exemptions you are paying practically nothing in your effective tax rate as a military member. I never deployed but did a lot of TDY's and my effective tax rate on active duty was single digits. If you have a civilian job and the question is 24% tax rate today vs. unknown future rate there is a big debate about what your tax rate will be in retirement relative to that. But if you're comparing your future tax rate in retirement to the sub-10% you're paying today you can guarantee that your retirement taxes will be higher than that. Even capital gains will be taxed more than that. A Roth account is a huge benefit to Active Duty military.

-

@katdude If you’re day-trading stocks trying to guess the reaction to earnings then you aren’t value investing and any discussion of the balance sheet is moot. But I’ll leave that aside for now. I agree that you should pay for what a business is worth today and paying inflated prices for speculative growth stories usually ends in tears. But book value is not really what the business is worth today. In a competitive market if you are earning returns in excess of your cost of capital, unless you have a specific competitive advantage, you will see competitors enter the business until the returns decline to your cost of capital. The reason book value mattered in manufacturing business or railroads for instance is those physical assets drive the value of the business and book value is a rough estimate of the cost it would take for a new competitor to replicate your business and enter the market. If I want to create the next Nvidia to get a piece of their amazing 45% ROIC, the less than $1B of PP&E they own has very little to do with their $12B in sales and $160B enterprise value. Those thousands of engineers they employ to develop new chips and who they pay collectively $2B a year drive much of that value. But GAAP says R&D is an expense and you can’t capitalize it on the balance sheet, ergo no book value. Is NVDA really worth $275/share? I don’t think so. But is it only worth $13.37/share in tangible book value? I highly doubt it.

-

This is a fundamental misunderstanding of value investing. Very few businesses are tied to book value. Financial firms tangible book value matters a lot, manufacturing heavy businesses book value can matter. Lots of important things are not captured in book value and not even Buffett is buying based on Price to Book these days. You should be looking at free cash flow generation, ROIC, earnings yields, and most importantly return on incremental capital employed. These are the things that take a fundamental knowledge of the business to understand and figure out. If you can type it into a yahoo finance search and have answers in a few seconds I can guarantee you that any excess returns that "strategy" might have had in the past has gone away to the algorithms.

-

Robins AFB August 4 IRR Muster Pay ?

MilitaryToFinance replied to Dfas1148's topic in General Discussion

Isn't muster pay like $10? Are you that hard up for cash to waste time on phone calls over that? -

Leaving the Air Force for Something Other than the Airlines

MilitaryToFinance replied to HU&W's topic in Squadron Bar

Yes, I always assumed my username was a not particularly subtle clue as to my post-AF career path. My industry is prone to booms and busts as well but I don't see any scenario where I end up back in blue at this point. I just thought it was odd to get a call in June 2018 after I got out in early 2013. -

Leaving the Air Force for Something Other than the Airlines

MilitaryToFinance replied to HU&W's topic in Squadron Bar

The Reserves must be getting desperate for folks. I got a call today from a Lt. Col. asking me how my transition to civilian life was going and offering that the Reserves are hiring if the transition is harder than expected. I told him that my transition went great when I separated in February 2013. Waiting over 5 years to give the sales pitch for coming back to the AF was probably a little too long. -

I've been using NBKC for my loan in New York. We haven't closed on the house yet but so far they've been great.

-

With all of the favorable tax treatments of income you get in the military you are probably correct that a Roth option is best. But what you really have to consider is your marginal rate vs. effective rate. Every dollar you contribute to the traditional TSP or a Traditional IRA comes off the top. You are deferring taxes at your current marginal rate. When you get to retirement what will matter is your effective tax rate on your combined income. If you stay a full 20 years and are replacing 50% of your base pay + social security + TSP withdrawals then this probably isn't as big a deal. However if you aren't going to have a military (or any other) pension, the effective rate on your withdrawals at retirement will likely be lower than your current marginal rate. Under the old tax code if you were in the 25% marginal rate then a traditional was most likely better. I haven't really run the numbers lately if the 22% rate works out the same.

-

Thanks. I'm letting my lawyer hash it out for now, sounds like it might just be boilerplate language. The seller won't have to pay anything, I'm putting 25% down, and closing usually takes 90 days here anyway so it shouldn't delay the process. There is really no logical reason to deny the VA loan except the inspection.

-

Has anybody ever seen a sale contract that explicitly says you can't use a VA loan? Purchaser shall get "a first mortgage loan, other than a VA, FHA or other governmentally insured loan."

-

Where I'm buying it takes 60-90 days to go from offer to closing. So a 60 day rate lock wouldn't have done much good, plus I was expecting to spend a couple months looking which I did in the end. From a historic perspective yes rates are still amazingly low. It still sucks to watch my quote on a 30 year Jumbo VA loan go from 3.375% when I started looking to 3.625%-3.750% today. On a jumbo every eigth of a point makes a big difference.