-

Posts

238 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Gallery

Blogs

Downloads

Wiki

Everything posted by Jon - Trident Home Loans

-

Thanks! Glad we did good by you! Let me know if you need anything in the future! Pleasure working with you. FYSA not the time to refi or buy right now if you can avoid it. Rates are jumping by .375-.5% overnight. We’re expecting things to settle but right now just making a list of potential refi’s and telling anyone buying to drag out settlement so we can look for dips to lock. Someone told me Today Navy Fed said 6 months to settle and the big boys are quotes up to 4.5%. Stay safe out there and watch out for the swarms of zombies. We’re running Trident out of a broken down school bus in the woods of WV surrounded by land mines. Jon

-

Thanks man! Always nice to help out an AF coworker! Don't feel I did anything special...just did what I'd want a friend to do for me. Glad we scored a great rate for you...I'm actually shocked we got it. This has been the craziest week ever...Mon 2.875, Tues 3.375, Wed 3.25, Thur, 2.75-2.875, Fri 3.49 on 30yr fixed VAs. Never seen swings like this before. I'm telling people if you don't need to lock (closing within 30 days) that it's best to sit on your hands right now. Today for the first time ever I saw VA and Conventional rate match...usually a .5%+ spread. This market is all over the place. Refi's are up 479% year over year nationally which is killing the mortgage industry/Wall Street. Seems that rates are artificially high because Wall Street is trying to kill the demand. Refi's are dead for now. Sorry definitely no crystal ball on where this is going. We're still the lowest in the country but what that looks like changes everyday. Hopefully we'll start seeing the market settle in the next couple weeks. Jon

-

Most lenders tell you what you want to hear until you see it on paper. The worst one I was see seeing last week was Navy Fed advertising 2.5% on a 30yr VA. Well when you read the fine print they were charging .5% in points and 1% in an origination fee. We were at 2.75 with none of that. So on a 400K home you'd pay Navy Fed 3K to save $52 a month which is a 58 payment break even point compared to 2.75% no points no fees and that's not including the extra interest you pay on that if you roll it in. Great if you're holding the house for 30yrs but that's the exception not the norm these days especially for military folks. We always quote no points and no fees...aka no tricks. If you want to buy the rate down that's up to you but usually I show people the break even and they make a more educated decision. Beware of the "sexy" rate advertisements...likely there is a catch. FYI rates aren't even close to 2.75% anymore...the refi demand is up 479% nationally over last year and the mortgage market is flooded. Yesterday we saw rates jump .25% because Wall Street is trying to slow the bleeding. If you're late to the party and still want to refi I'd wait a couple weeks for the dust to settle and in theory the wall will come down a little again so people can still get good deals. We were doing better deals back in Jan before the media got a hold of the refi story. Jon

-

U$@@ and Vets United are the biggest VA lenders in the country but have the worst rates of every lender out there. I usually beat them by .5% easily...anything decent you find on their site has fine print costs.

-

Thanks man! That was perfect timing! Glad you caught me before I took off. Trident def isn’t a M-F 9-5 gig...we help whenever we can. Anyone could call Marty the owner right now on his cell and he’d pickup. Good luck calling U$@@ and trying to even get some random loan officer on the phone on a weekend let alone the CEO. Jon

-

Not sure I understand the fee part...I think you might be talking about a recast vs a refi which is when the amortization schedule is rerun after you put a chuck of money down. That’s one a conventional loan thing and you stay at the same rate/term. A recast eliminates all the refi costs and lowers your principle and interest every month. The VA IRRRL (streamline refi) rules changed last year and so doing a 30 to 15yr IRRRL is basically impossible. It’s a non-income documentation loan so your ability to make the higher payment isn’t verified. The rule is your principle and interest can’t be higher on the new loan vs the old loan which can’t happen on a 15yr in most cases. There are a couple other small exceptions but in general the VA has blocked 30 to 15yr IRRRLs. Rates are essentially the same on a 30 and 15yr VA...maybe .125% spread on a good day but a lot of the time they are exactly the same so you can do a 30 and pay it like a 15 by adding the extra principle with your payment every month. Hope that answers your question. Call, text or email if not. Jon jk@mythl.com 850-377-1114

-

It's all case by case...how long you're going to be in the house, loan amount, how much closing costs would be, VA disability or not (if you have to pay the funding fee). The VA requires a minimum of a .5% reduction too. You're pretty darn low that you might never win with the refi depending on when you'd move/sell. Lots of variables. Shoot me an e-mail or call and we can get you a quote once we get some data from you. We wouldn't recommend you do something that doesn't make sense to us. Need: Zip code Loan amount VA disability Current rate Primary residence or not VA disability or not Jon jk@mythl.com 850-377-1114

-

Good question we get a lot. The fed is totally independent from mortgage backed securities. The fed controls short term lending where as mortgages are long term products traded on Wall Street. Mortgage backed securities investors control mortgage rates...VA included. If they need to get more demand then rates come down but right now the demand is crazy with VAs below 3 and conventionals just above 3. Rates seem to have found a bottom but of the strong demand. It's more likely that the Fed decision will help stabilize the market and once the China virus is out of the news we'll see rates return to normal levels. I don't have a crystal ball but that's the current commentary in our circles. Jon

-

My pleasure and thank you! Looking forward to helping you with the new house! Debt to income is run off min monthly payments so just the $980 will be considered. That is what we used when we looked at the new house numbers earlier in the year. Let me know if you need anything. Jon 850-377-1114 jk@mythl.com

-

Can’t do an IRRRL to get cash out cause it’s a streamline. That’d be a VA cash out which is a full documentation loan and comes with a 3.6% VA funding fee if you don’t have disability. Wouldn’t change cost basis and if you live in a house for 2yrs you don’t pay taxes on any proceeds. Not a CPA though. Yes to “recasts” but only on conventionals. Can’t do them on government products. It’s a one time deal within a yr of closing ($195-295 fee) and takes effect 60 days after the request/payment.

-

lol, more like a troubleshooting ETIC...then the parts + x ETIC but definitely just stay on the hook and certainly don't cancel.

-

Yes all mortgages require a hard credit pull to underwrite them. Haven't ever seen it impact someone with good credit. Servicing rights get sold a lot. Our main servicer tells us they shoot for a min of 18 months and usual sell by 3yrs. Jon

-

Thank you! Glad to hear you were happy with the process and rate. Can't beat the no cost option where we bump the rate up a little bit to cover all the closing costs with a lender credit. Nice alternative than adding extra debt especially if you don't know how long you'll own the house/when you'll PCS. Usually adds about .25-.375% to the bare bones no points no fees rate depending on how much of a lender credit we have to give, but then you just save money without a break even point. Different strokes for different folks. Thanks for reaching out to us and trusting us with your refi! Enjoy the extra cash! Jon 850-377-1114 jk@mythl.com

-

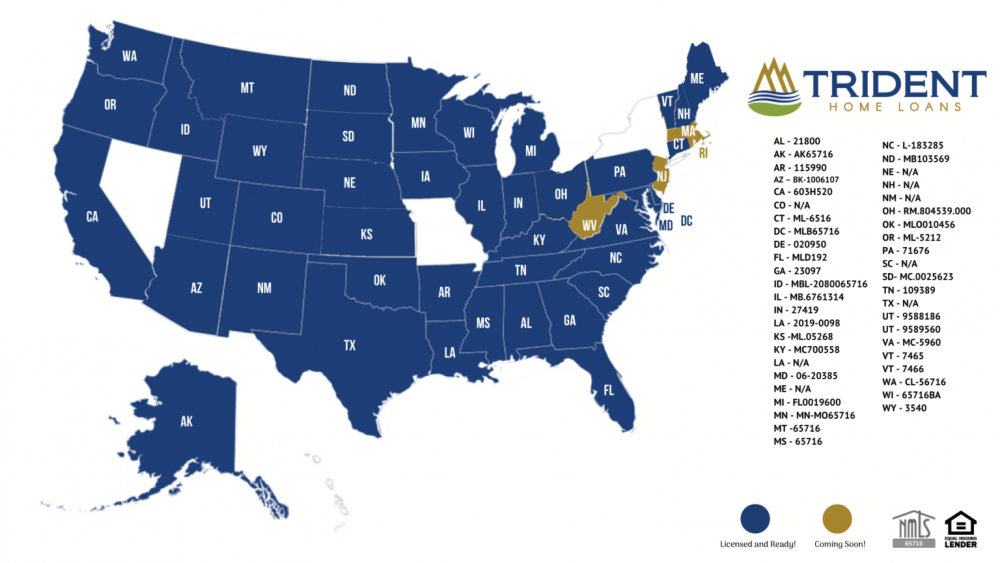

Unknown sorry! Nevada is a tricky state like AZ was for us. We actually have to have a loan officer who works for us live in that state and then we need to open a physical branch. It's not out of the realm of possibilities since we did it in AZ but we gotta find the right person first. Consider it a rolling ETIC for now. Jon

-

Thanks man! Always nice to help a fellow Southwest guy save some money! See you out there. Jon

-

Thanks! Just before the 2.75% no points IRRRLs spins out of control we’ve had some days when we’ve been able to do it. Other days we’ve been at it with $550 in points but mostly we’ve been at 2.875. It’s all Wall Street driven but our promise is we’ll always give you the beat deal possible. Definitely a great time to look at a refi. Jon

-

Thank you! Definitely enjoyed helping you and glad you were happy with everything! Jon https://www.blink.mortgage/app/signup/p/tridenthomeloans/jonathankulak Slowly but surely adding more states

-

Let me know if anyone has a spouse/significant other/friend in our local area (Fort Walton, Navarre, Pensacola area) who is looking for a good job. We hire for attitude and train for skill. Looking for a motivated person who is organized and a self-starter with thick skin to process loans. Experience would be amazing but we can train from scratch if they have the right personal qualities. Limitless earning potential if they get their license and start doing their own loans to add commission to their salary. Working remotely is also viable once they are spun up. We do mostly VA loans and work with aviators so anyone recommended by you guys would likely be a great fit. Fire me an e-mail or call for more details...jk@mythl.com or 850-377-1114. Needs to be local for months of training unless they are already in the industry. Jon

-

Caliber has a retail side and a wholesale side...we work with them on the wholesale side which is how our pricing is so much better than their retail operation. Same company servicing the loan but you get two different experiences and pricing. Quicken is the same way. We used to work with Quicken but they are terrible. Thank you! Glad we finally got to work together. I'm always to first to tell people to use the preferred lender with new construction if the closing cost incentives are tied to using them and we can't match them. It's a crappy game builders and preferred lenders play but money is money. Jon

-

You're welcome Sir! It's been a pleasure working with you on all three of these! Rates are definitely stupid low right now because the coronavirus is hitting the world economy hard. Anyone who wants a quick sanity check on streamline VA refi rates just e-mail me: 1) Zip code 2) Current loan amount 3) Credit score 4) Current rate 5) When you closed on your last mortgage 6) VA disability or not We always quote our rates with no discount points and no lender fees whatsoever. Not saying we can't be beat but we're not seeing it happening either. Jon jk@mythl.com 850-377-1114

-

Glad we were good to you! Sorry we're not licensed up in NH yet but we're working on expanding to over 40 states by the end of this year. Your broker is "kind of right". Ginnie Mae buys up all the VA loans and sets the secondary market rules. The VA allows you to go up to 100% LTV on a cash out but Ginnie Mae puts a pricing penalty on over 90% LTV. It's usually about .375-.5% worse rate wise, but it definitely can be done. Some lenders won't do the 90-100% LTV cash outs because they go into a different Ginnie Mae pool, but there are plenty of lenders like us that will. I just caution guys that they aren't going to get as low of a rate. That being said, rates are so low right now that even with the pricing penalty I'd imagine even a poorly priced lender should be able to get you a lower rate then what you currently have when they do the cash out at 100% LTV. Side note, if you don't have VA disability the cash out funding fee went up to 3.6% this year which is a tough pill to swallow. I just had a guy looking to do a cash out call me and I recommended he apply for disability if he doesn't need the cash right this second because it'd save him $17K. Only having the loan for 9 months isn't an issue. Loans are considered seasoned after 6 months/6 payments. Hit me up if you can't find someone licensed in NH who can do it for you and I'll get you a referral through one of our investors who I know will be able to do it for you. Jon 850-377-1114 jk@mythl.com

-

Ideally have your VA disability app in too and there is a good chance you won’t pay the VA funding fee. The VA will expedite claims if you’ve been to your exam appts and are trying to do a mortgage. We’ve saved guys tens of thousands in funding fees by requesting rushes through the VA regional loan centers Jon

-

Just to clarify...the new rule allows the VA to insurance loans with no max limit. Just because they’ll insure it doesn’t mean you can borrow it. Debt to income limits, credit and underwriting will be the limiting factor in what you can borrow with or without a down payment. As far as the down payment part of an offer what you put on the offer/contract doesn’t drive the mortgage required down payment. If you qualify zero down but you put 10% on the contract you can still do zero down and the seller is none the wiser because they don’t see the loan. We still this happen a lot in very competitive markets like the DC area and Cali. It’s a very common realtor tactic. Jon

-

Thank you! Always nice to work with the same good folks again and build that lasting relationship vs it just being a transaction. We always reach out anytime we can save money for a prior client especially when we can do it for free. Let me know if you need anything in the future! Jon Cell: 850-377-1114 jk@mythl.com

-

Thank you! The no cost refi is a definitely a great way to go. Can't beat saving money, every month, skipping a payment, and not paying or financing anything to do it. Glad we could make it go smooth for you, Jon