-

Posts

238 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Gallery

Blogs

Downloads

Wiki

Everything posted by Jon - Trident Home Loans

-

Thanks bud! Always fun helping out a fellow '05 Aggie! Glad we could save you cash and cover all the refi costs for you! Let me know if you need anything in the future. Jon

-

Thank you Sir! We enjoyed working with you too! Just for comparison sake we did this one with .3% in discount points to get 2.875% and a really big bank in San Antonio is advertising 3.25% with 1% in discount points. Definitely shop around. Still getting calls from guys who are sitting over 4% that we are doing IRRRLs for. Give a call...no point giving the banks extra interest. Worst case I'll tell you it doesn't make sense and we'll talk about flying. Jon 850-377-1114 jk@mythl.com Sr Loan Originator, 737 FO, Former AC-130 pilot, Texas A&M '05

-

Use the county limit for where you're looking to buy. If you're looking to buy in a high cost area that has a higher limit you get extra buying power. Always worth looking at surrounding counties. I had a guy in WA buy in a different county so he got bonus entitlement to use and thus didn't have to make a down payment. Not always possible but it's a good thing to check if you're low on entitlement Yes, as long as you qualify debt- to-income (DTI) wise. That's the beauty of the new 2020 rules! The VA is also one of the more generous of all the loan programs on how high you can go on your monthly DTI. I've seen the automated underwriting software approve up to 65% monthly DTI with good credit. Seems to cap guys at 50% if you're below 700. It's all case by case. The new no loan limit combined with VA disability is the killer combo. Just closed a Southwest pilot in CO on an 800K house with zero down at 3.125% and no funding fee because he had VA disability.

-

Attached are the new VA guarantee calculation examples for 2020. Figured I'd post them in case anyone wants to nerd out on how to calculate how high of a loan the VA will back without needing a down payment. Full entitlement is easy...no max after 1 Jan 2020. Partial entitlement requires some math. You'll also need the county loan limits (CLL) which you can find at: https://www.fhfa.gov/DataTools/Downloads/Pages/Conforming-Loan-Limits.aspx Let me know if you need any help running the numbers. Jon 850-377-1114 jk@mythl.com guaranty_calculation_examples.pdf

-

Thank you and congrats on the no cost cash out! Worked out to be a great deal! I'll pass on the compliment to the girls! Let me know if you need anything. Merry Christmas! Jon 850-377-1114 jk@mythl.com Left to right: Alena, Lisa, me, Taylor, & Elena

-

Locked 2 guys today in CO at 3.25% at no cost (non-jumbo 30yr VA, 750+ credit score). We'll cover all your closing costs and VA funding fee (if applicable). If you're at 3.75% or higher in CO let me know and we'll get you dropped down and skip a payment in the process. Nothing rolled in or cost to you. Just need a quick (5 min) prequal app on our website at www.tridenthomeloans.com to get it going...skip the income or debts portion (not needed for a IRRRL). Jon Update: Relooked at the numbers and IN, IL, WA, KY, CA, SC, AL, AR, TN, and VA will also work.

-

Pleasure working with you again! Glad we could get you lowered down for free and save you some good money! Let me know if you need anything in the future. Have a great Christmas and New Year! Jon Cell: 850-377-1114 jk@mythl.com

-

Good news for 2020, the Federal Housing Finance Agency announced today that the standard non-jumbo to jumbo loan limit is going up from $484,350 to $510,400 for any loans closing after 1 Jan. Jumbos have more rules and the rates are higher so hopefully this increase will help save everyone some money. The VA loan limit cap is still going away in 2020 for those with full VA entitlement remaining, but $510,400 will be where the rate/pricing changes. Rates are still super low so anyone at 3.75% or higher on a VA loan should take a quick look to see if a refi makes sense. Some states are really cheap to refi in and some aren't. You can also always do the no-cost option where we cover the refi costs for you in exchange for a slightly higher rate (usually .25-.375%) above par. No-costs are great for active duty guys because it just saves you money with no break-even point or costs rolled in. Hope everyone has a great Thanksgiving! Jon 850-377-1114 jk@mythl.com

-

Give me a call Duck, but if he still has the $375K loan counting against his entitlement he's going to have to put money down. Also with the income we'd need to look at DTI because he hasn't been a landlord before and doesn't have a tax return filed yet showing rental income so that could be an issue. Not really a simple answer I can give without looking at all the numbers. Cheers! Jon 850-377-1114

-

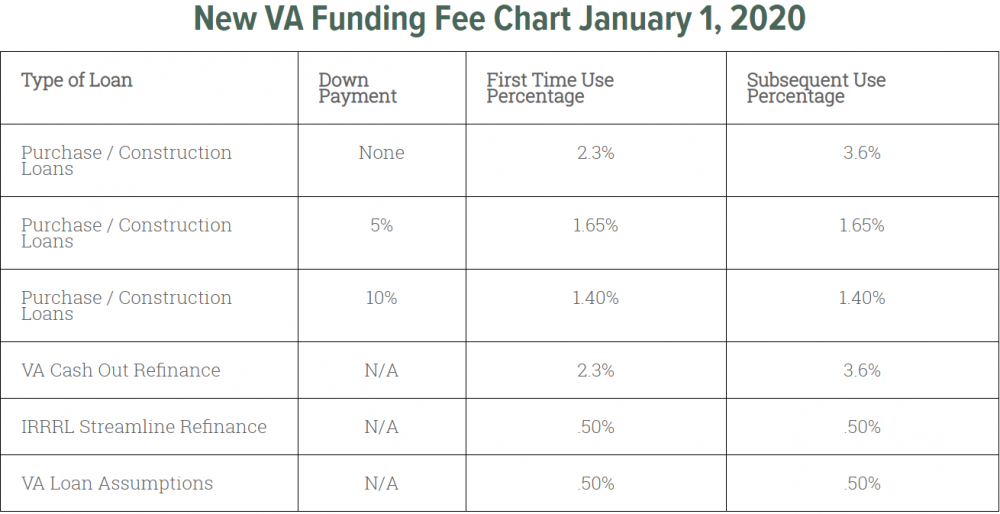

Sorry haven't seen a calculator with the new funding fees built in yet but here is a table that breaks them down for loans closing after 1 Jan 20. There won't be a loan limit for zero down loans if you have all your VA entitlement remaining (either never used it before or have had it restored). If you still have some of you entitlement tied up then there will still be limits and/or down payment required. Let us know if you need help figuring out the numbers based on your specific situation.

-

Yes and no. As your lender the VA gives them the option to allow escrow waivers or not. It is not a government rule like you were told anymore...it used to be but it changed sometime around this time last year (don't remember the exact date). Most lenders aren't allowing veterans to take advantage of the change. The reason we do is the servicer we use keeps the servicing rights for the life (or at least that's their intent) of the loan so they can ensure your taxes/insurance are up to date to stay in compliance with the new VA rules. Most servicing rights get sold multiple times which is why lenders aren't allowing the escrow waivers because of the added risk. Depending on what rate you have you could refi, save some money, and remove the escrows if you want. Let me know if you want to take a look at that option. Jon 850-377-1114 jk@mythl.com

-

That’s actually not true, we waive escrows for VAs all the time for free as long as you put 5% down. The VA used to require escrow accounts but they now leave it up to the lender. Most lenders either don’t know this or just don’t want to be more flexible with their borrowers. I’ve actually had other lenders tell our clients while they are shopping around that we are lying and it can’t be done. Other lenders just don’t know the rules like we do or if they do they choose to not put their clients first by taking a little added risk. We’re all about helping you keep as much money in your pocket as we can. We mitigate our risk by working with only the best clients like y’all. Here are the references. Cheers! Jon 850-377-1114 jk@mythl.com VA Lender Handbook: “VA does not require the lender to establish escrow accounts for the collection and payment of property taxes, hazard insurance premiums, and similar items. It is the lender’s responsibility to ensure that property taxes and hazard insurance premiums are paid timely.” -Pg 9-25 https://benefits.va.gov/WARMS/docs/admin26/m26-07/Ch_9_Legal_Instruments_Liens_Escrows_Related_Issues.doc

-

Not sure who this is or what the issue is but feel free to give me a call anytime. We are busy because of our great rates/service but not overwhelmed. I'm always available to answer any questions. We shoot to close our refi's towards the end of the month to save you on prepaid interest/closing costs and maximize your savings. IRRRLs are mostly hands off loans so not much for you to do except save money. I always have my cell but haven't got any calls regarding this. Sorry...I'm standing by for you call. Cheers! Jon Cell: 850-377-1114 jk@mythl.com

-

Thanks Steven! Glad we could get you a great deal and save your growing family some money! It's always a pleasure to work with you! If any of you guys are looking for a great realtor in the DC area definitely get in touch with Steven! He's a solid guy that I've worked with a few times now, father of 3 kiddos, former B-1 WSO and a AF reservist in DC. He's on the #1 realtor team (Keri Shull) in the DC area so you're getting great service and working with professionals. They also match or beat the realtor credits/incentives that USAA used to offer (they just ended it) and Navy Fed still does (for now at least). Hit me up if you want his personal contact info or I'm sure you can PM him on here. Cheers! Jon jk@mythl.com Cell: 850-377-1114

-

Thank you! Always enjoy helping a fellow Southwest guy save some money! Even better with a lender credit to pay for everything without you having to come out of pocket or roll anything in. I'll pass along the compliment to my processors. If anyone else wants to look at numbers just email: Property address (let me know if it's your current home or a rental property) Type of loan on it (VA, Conventional, FHA, etc) For VAs - if you have VA disability or not Current rate Amount currently owed Estimated credit score Cheers! Jon 850-377-1114 jk@mythl.com

-

Thank you, Sir! It was definitely a pleasure to work with you! Helping good people save a ton of money is the best part of this job. I have 4 kiddos so your Dad compliment definitely means a lot. Enjoy the upcoming wedding and please let me know if you need anything in the future. Have a great weekend! Jon

-

Just depends...you have to go down by .5% at a min to do an IRRRL. If it's a cheap refi state we've done 3.25% no cost IRRRLs so you don't have a break even and you just save money. If it's a more expensive state or you're paying the cost then I'd run a break even analysis off the costs and saving then compare it to how long you're planning on staying in the house to see if it makes sense. If you're PCSing or selling in the not too distant future typically only the no cost IRRRLs make sense. Best thing is just to do an app on our website or call me so I can run the numbers and see if it makes sense. If we have an app in and I have talked to you then I can also hold it and watch the market for you then auto lock when we hit the right numbers. You're never committed to anything on a refi until 3 days after you close so there isn't any downside by locking or exploring your options. If rates drop then we just cancel the first lock and set you up with a new lock so the first lock is just a hedge. Jon 850-377-1114 jk@mythl.com

-

That's a great question that I've been getting a lot over the last couple days. This article explains it best but the bottom line is the fed controls short term lending not long term lending and mortgages follow the trend of the 10yr treasury bond. The bond bottomed out a couple weeks ago when we hit a low of 2.875% on 30yr VAs and rates are back to 3.25%ish but it's always fluctuating everyday. The bond was as low as 1.43% but its back to 1.77% which is a significant short term rise and thus the mortgage rate rise. The bond drops when investors moving out of the stock market and into bonds for security during the "sky is falling" events. The increase demand for bonds results in the bond paying lower yields thus mortgage rates paying less to investors in mortgage based securities (MBS). MBS are where every normal loan ends up that is originated in the country regardless of who the lender is. https://www.mortgagenewsdaily.com/consumer_rates/922003.aspx Hope that helps! Jon

-

Thanks man minus the MC-130 insult...don't lump us gunship guys in with them;) I definitely enjoyed working with you too and am happy we were able to get your family into a great place with a great deal. Let me know if you need anything in the future. Cheers! Jon 850-377-1114 jk@mythl.com

-

You're welcome! We're always here to help you guys. Jon

-

Lots of variables that go into rates but in general you're looking at 3.125-3.25% on 30yrs VAs with a 45 day lock and no points on a non-jumbo. Rates have been moving back up with the 10yr treasury bond off the bottom we hit at 2.875% a couple weeks ago. These are Trident pricing not the national average. Also know that the mortgage market is constantly changing on Wall Street so this post could be completely irrelevant tomorrow. Best thing is just to call me to get a real time quote. Hope that helps get you in the ball park though. Jon 850-377-1114 jk@mythl.com

-

Sure are and rates are great right now. Give me a ring whenever you have a few minutes. Jon 850-377-1114 jk@mythl.com

-

lol, thanks man! You're welcome and thanks for the repeat business. No catches ever. We do our best by everyone and we get the "it seems to good to be true" all the time. We treat everyone like we'd want to be treated which is the Trident difference in business today. We want a life time relationship with every client. Everyone will PCS multiple times, go to the airlines, or change houses at some point and will need a lender again. We want to be your first call every time. Cheers! Jon

-

You’re welcome and thank you! Sorry for the late reply I’ve been flying and kept meaning to reply. Always happy to help out a fellow airline/military guy. Great time to do an any type of mortgage. Definitely don’t hold back from calling us or lump us in with all the junk mail for refi’s that everyone is getting. We’re no pressure and straight forward...wouldn’t ever try to sell you something that wasn’t in your best interest. Only here to help...we make money by providing a great product and service. Not by charging fees or pushing you farther into debt. Jon 850-377-1114 jk@mythl.com

-

You're welcome! Elena did a great job as always. I still can't believe that local guy was over 1% higher than us. We see tons of quotes from lenders across the country and that was one of the worse. We usually beat everyone but that one was not even a competition. Thanks for trusting us to take care of you and your family! We're always happy to quickly sanity check any rates people are getting quoted without a mass of paperwork or credit pull. Jon 850-377-1114 or jk@mythl.com Sorry, no OH yet. Marty is pushing to get us licensed in as many states as we can over the next year, but it can be a slow process in some states. Banks are automatically licensed in every state. I'll ask around for a good OH lender referral for you. Amy is right on the funding fee stuff. Based on your scenario, you won't be able to get it refunded if you close on the refi before the disability award date next year. The VA is trying to push through claims if you're buying a house so that the award is prior to closing even if you can't get your check until after your official separation or retirement date. You can apply up to 180 days prior to separation/retirement which can definitely help people as they transition out and need to buy a house but want to avoid the funding fee. https://www.va.gov/disability/how-to-file-claim/when-to-file/pre-discharge-claim/