Everything posted by ViperMan

-

The new airline thread

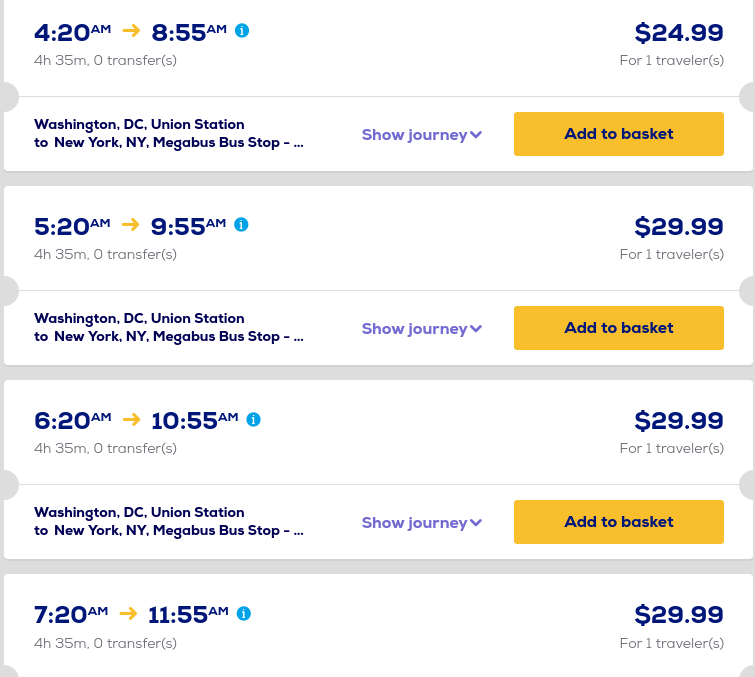

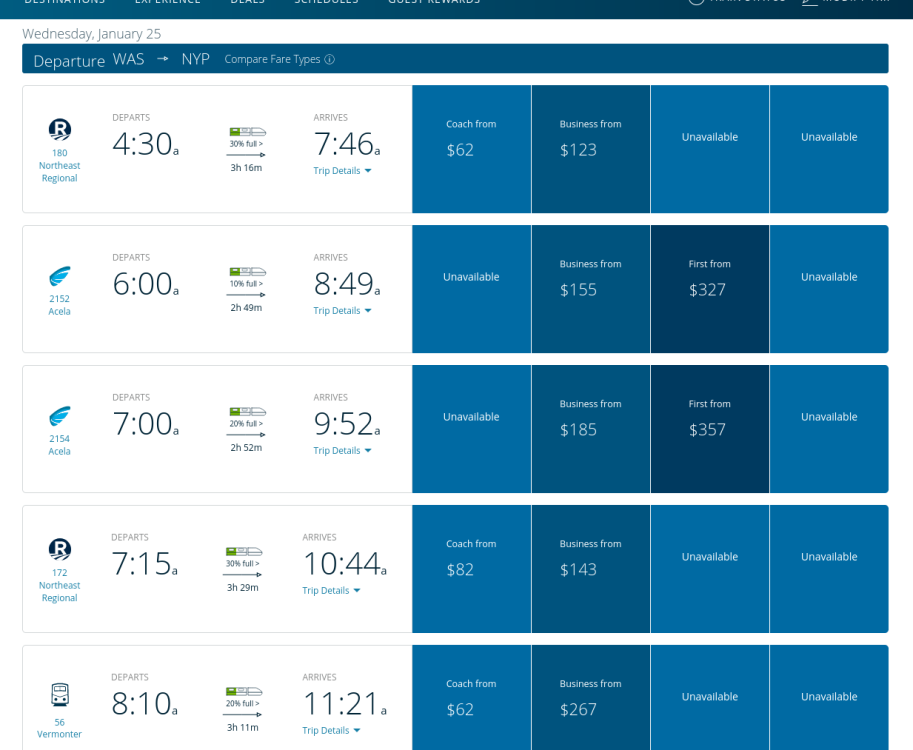

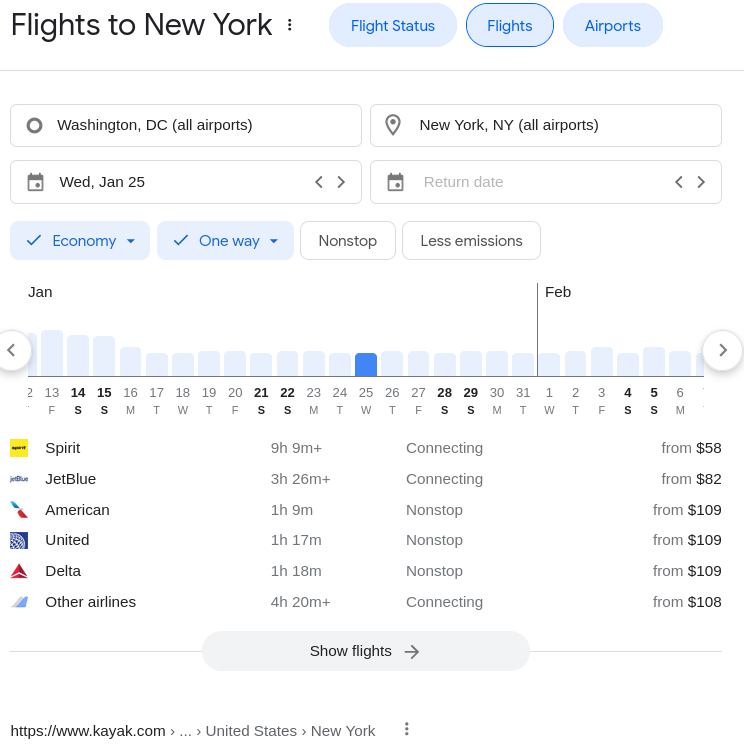

I don't know why, I just feel like proving you and @nsplayr wrong. Here are bus tickets, train tickets, and air travel from DC to NYC on Jan 25th. Do your own research if you don't trust me. Train is the LEAST convenient in terms of time and $. $25 for a bus, $60-100 to fly, $60-360 for the train.

-

The new airline thread

Ohhhhhhh ok. So what you were really saying is that in your *hypothetical* world, train travel would be more convenient than air travel. Missed that part. So much here. 1. If you're arriving at the airport 2 to 2.5 hours early, you're wasting your life. No shit. Only my grandmother shows up that early. And even she is wasting her life when she gets there that early. 2. I went to Europe after having last visited 10 years prior, and lets just say, train ticket prices are now exorbitant. You might be able to catch a cheap fair between London and Paris, but if you want to *see* Europe, well, it aint the early 00s where your gonna grab $250 Eurail pass and see the continent. Sorry to break it to you - those days are long over. 3. Ryan Air is cheaper. 4. German Wings is cheaper (as long as their pilots don't run you into the Alps). 5. Sweet spots might exist in Europe, but in the US (places like LA), you might need to fly from Compton to Huntington Beach to achieve the 2.5 hour *pressure* relief you're talking about. Last I checked, there's not many Compton to Huntington Beach flights available to the general public. You're comparing apples and oranges. You got to take the 405. There is no other option. Those are facts. I don't know what you're talking about. Yeah, there is room for rail and trains in this country. Why the F we have so many big rigs going coast to coast is beyond me. All that shit should be moving by rail. Get the fuck off my interstates. But yeah with your theme: trains should be a thing in this country. The point is, right now, they are not. They could be, they should be, but they are not.

-

The new airline thread

I *feel* you bro, but do you realize it's cheaper to fly from DC to NYC than it is to take the train??? A train ticket from DC to Manhattan can cost >$400. AYFKM? The only *cheap* travel option along the eastern sea board (that I've found) are the various bus companies (Megabus, etc). Also. No. Flying is 1000x times better than taking a train as far as convenience goes. Period. Were you serious with that? Spend 2.5 days to get across the country or do it without even taking a leak...yeah I'm going with option B.

-

Big Tech Oligarchs

I don't disagree with any of this and you make some important observations about these programs' implementation, but there is an important distinction you're not acknowledging: power companies are NOT a free market, and they are NOT capitalism. If you want to start a supermarket, record label, software company, fast-food chain, brewery, or consultancy, or any other number of businesses, you're completely free to do so. You are not free to just start a competing power company and start running your own power lines, installing utility poles, tearing up roadways, utilizing public rights-of-way or easements on private property, etc. The government has a direct hand in ensuring the viability of power infrastructure. There is a categorical difference between these types of companies, so while power companies appear to be companies, they're really part company, part government. In any case, insofar as ME (who personally has no solar) selling power "back to the grid" using public infrastructure (the same thing the power company does) I don't see any problem at that level of analysis. There is no reason why one entity should be allowed to conduct business using public property while I am not. A government that disallows that, or privileges other businesses over others (me) is engaging in a totally anti-capitalistic practice.

-

Big Tech Oligarchs

Power grids are public infrastructure, or are at least part of it - insofar as they utilize public rights-of-way, law, etc. Why, then, should you not be paid if you add power to the public grid? Businesses whose money-making models rest upon public infrastructure (power companies, internet, water, and so forth) are not businesses in the usual sense and hence can and should be regulated appropriately. In some sense, you're no different than the power company themselves. If you're adding voltage to the system, you deserve to be compensated for that. The grocery store analogy is off because grocery stores do not require government intervention in order to conduct their business. Power companies do; they are not free market capitalism.

-

ADAIR 38s/ Langley

What CAF assignment? And what's your other option?

-

The Next President is...

Damn right it's good law...GREAT law. $$$ Law. June: https://www.marketwatch.com/story/nancy-pelosis-husband-buys-millions-worth-of-nvidia-stock-ahead-of-chip-manufacturing-bill-vote-11658179117 August 9th: https://en.wikipedia.org/wiki/CHIPS_and_Science_Act September 1st: https://www.foxbusiness.com/politics/paul-pelosi-dodged-extra-20-loss-selling-nvidia-stock-july-august-us-restrictions

-

The Next President is...

Your post reads like an invitation to becoming better-informed. If that's an authentic feeling, you might consider checking out this podcast: https://podcasts.apple.com/us/podcast/all-things-re-considered-with-peter-boghossian/id1650150225 It's from a (previously) liberal professor who has witnessed the change in tone and tenor in the conversation that has taken place inside American universities (and bled over) over the last 10 years. He was one (of many) who have been subjected to the increasingly illiberal attitudes and actions that are finding aid and comfort in our society. At times it has some hokey elements, but overall it is sharp and on point. Boghossian and his co-host correctly identify the broader trend in some of our cultural institutions (i.e. NPR) that are working to enable such illiberal attitudes, that being: lies are now espoused and propagated as truth, and these lies are in turn used to enable illegitimate power. He and his co-host pick through numerous stories and how they were reported on NPR. He then contrasts their reporting with what actually happened and lays bare the striking contrast between those two things. A podcast with this type of meta-reporting is something which was sorely overdue, and deserves much accolade. Case in point: the Kyle Rittenhouse saga. NPR worked overtime casting that story in a false light. They systematically dive into the details, how easy it was to get it right, and how NPR got it so exceptionally wrong: to listen to NPR is to become misinformed. Their reporting is conducted in a soothing, breathy tone, and in delectable, oh so perfectly-enunciated English, but it is largely a disinformation network. Your complaint about Republican over-focus on "dog whistle" issues is fair, but it's also wholly incomplete. There are real constitutional issues that were on trial in the court of public opinion, which are not diminished by the other "issues" you raised. NPR played (and plays) a major part in the mosaic of propaganda that makes up our information space. For my part in the mid 2010s, I underwent the same transformation as espoused in many of the show's featured vignettes with regard to NPR. I listened to it everyday on the way to work - yes, I am an ex-NPR acolyte - but somewhere in there it just became insufferable. I couldn't point at any one thing, but my belief is that their transformation coincided directly with the 2016 presidential election. Wrapping up: it's all well and good if you don't believe the "media is stacked against us" argument, but there's a source for you that lays it out in black and white. To all my conservative friends: it's a good podcast in that it goes far deeper than just shouting at the TV and yelling "get off my lawn." In short, it's actual reporting.

-

The Next President is...

Girls, girls...it wasn't just the DNC that acted to suppress the laptop story...more than 50 MAJOR intelligence officials came out in unison - WITHOUT EVIDENCE (or maybe with???) - and stated that it was a Russian hoax. That was false. Those same officials are eerily quiet right now. Accountability much anyone? The number of officials who have gotten it wrong and felt zero (0) need to go back and correct the record or publicly re-evaluate their thinking over the past number of years is sickening, and it portends very, very bad things for the future of our country because not only do the PTB not care about having gotten it wrong, this shows they no longer care what us proles think, and it demonstrably proves that they are not politically neutral. Politically neutral entities have no reason to not go back and correct the record. Amirite? https://www.politico.com/news/2020/10/19/hunter-biden-story-russian-disinfo-430276 Generally speaking, heads of TLAs don't all speak out together about things that "aren't a big deal." It was and IS a big deal. I invite you to conduct a brief thought-experiment. Imagine for one minute that the propaganda you're steeped in is invisible to you. What does the world look like? Are you sure about that 5 minutes!!?? Stated differently: The TRUTH “has all the classic earmarks of a Russian information operation.” Makes you think.

-

The Next President is...

Watched this a bunch, and I've yet to hear him call for a riot, coup, or insurrection. Now, it's some Dem's turn to post the part where he does. I'll wait.

-

The WOKE Thread (Merged from WTF?)

#doubleracist

-

COVID-19 (Aka China Virus)

LOL, so you get to use your special pass for the day spent in bed with the shakes and chills as your body reacts to the shot?!? Sounds like a great idea to me. 🤣

-

The WOKE Thread (Merged from WTF?)

Duh, guessing is racist. I'm surprised you didn't know that.

-

The Next President is...

All the Rs are lamenting the midterms. But for me, there's plenty of silver lining: I'll take Roe v Wade. I'll take the death of collegiate Affirmative Action. I'll take Biden and Harris having to run on the dem ticket again. I'll take Florida. I'll take the House flipping (pending). I'll take more government gridlock. I'll take the repudiation of Trumpism - it needs to die. I'll take all of that 10 times out of 10 for the republican's coming up short other day. It's a perfectly fine trade to me. You can't win everything.

-

Money and Finance

Ah, ok. I'm tracking what you're saying now. I agree.

-

Money and Finance

Aren't those things one and the same?

-

The WOKE Thread (Merged from WTF?)

Some things just take time, and other things are completely beyond your control. The sooner you realize that, the less grief you'll feel over not being able to convert or connect with the crazies. Do you honestly think you're going to be able to "logic" your way into someone's feelings? What I'm saying is that there may be no "how," as you put it. If there was a "how," then by corollary, there would be a correspondent "how" to get you to think boys can be girls. Do you think there is a "how" that will accomplish that? Yeah I didn't think so. No. Sometimes, you just need to batten down the hatches, preach the truth to anyone who will listen, protect who you can, and let the shit collapse under its own weight - like seems to be happening right now in places like Oregon. To not be too cynical though, honestly, the best thing to do is probably approach all this indirectly - i.e. don't focus on "defeating" your opponent or converting people to your team. Create (or participate in) good institutions that reflect your values and be truly welcoming to other people who don't necessarily think like you. Put another way: show them, don't tell them.

-

The WOKE Thread (Merged from WTF?)

My hat's off to you. I used to listen to NPR on my way to work as well, but it became absolutely too much for me. Now I only listen to it when I want to piss myself off - which is to say, never. It's blatant propaganda. Now that I recognize it as such, I see less value in *understanding* where they are coming from. Their message is from a different universe, using different facts, using different logic. Once I grasped that, I understood there was no longer any return for my time and attention. Yep. I wish more Rs and Ds understood this. We would have more productive conversations about how to help people out. Oh well.

-

The WOKE Thread (Merged from WTF?)

Fair enough, but they're so far gone, fact, reason, and logic aren't going to work either...hence, I'll choose ridicule and laughter.

-

The WOKE Thread (Merged from WTF?)

Oh. There is NO doubt about that. You either have a DEI slide in your sales pitch and have HR "on board" with hiring people based on immutable characteristics, or you can kiss any privilege the government grants you in whatever field you operate in goodbye. Period. Appease the God in government, or GTFO. Look at every airline right now. United is trying to hire 50% "POC" (whatever that means) and women. And it's not because they thought it up in a corporate meeting all by themselves.

-

The WOKE Thread (Merged from WTF?)

#1, but with a whole lotta "been woefully misled" into thinking all manner of asinine things.

-

The new airline thread

For a newb, can someone define BOD and TA?

-

Worldwide Fighter Squadron Roll-Call

No clearer trap has ever been set.

-

UPT Next

I normally agree with your posts, but I think you miss the mark on this topic. Of course people's experiences affect their view of the world, their outlook, how they approach problems, and how they think. BUT, the left loves to use this as a substitute for their actual argument, which is that people with different skin colors necessarily have different experiences, and are necessarily different from each other. This is unequivocally untrue. Put another way, it's the argument that gets trotted out anytime the left wants to increase participation of group 'X' because of some reason, but they need a reason that sounds legitimate because of course the actual argument is racist. How do I know this? Precisely because of the argument you just made. No one - not one politician, not one general officer, not one pastor, not one poster on an internet forum, and not you, has ever been able to articulate why someone of a certain race has an essential characteristic that makes them fundamentally different from someone of a different race. Because of course, such arguments are inherently and correctly recognized as racist; hence the deferral to substitute arguments. The left makes an argument for including certain races based on characteristics that aren't tied to those races, and then justifies it with an appeal to different 'experiences.' Katie Hobbs' most recent hum and haw session in this Univision interview is exhibit #1. A 'true believer' was completely unable to describe why she thought so highly of her extended Hispanic family (as she should be unable to because of course she's not actually racist, she just plays one to her constituency). So we learned what she loves is "hanging out with them" and "practicing her Español". M'kay. What is glaringly obvious in this interview is that she doesn't believe a word of what she's saying, knows it's bullshit, but has chosen to say it anyway. Our society is endangered when our politicians are so willing to go there. This is not an indictment of Katie Hobbs. It's an indictment of everyone who thinks this way. It's effing poison. It's cowardly. "Yes" to the woman question. "No" to the Hispanic and black question. Women are different from men. Men are different from women. Regardless of the current social discourse. Blacks, Hispanics, and whites are not fundamentally different from each other. I know the left thinks the right is missing "context" in how our society operates. What the left is missing is that there is never a reason (good or bad) to discriminate upon the basis of race. Somehow we once knew this, but we seem determined to forget it and regress. Sigh.

- WTF? (**NSFW**)