-

Posts

769 -

Joined

-

Last visited

-

Days Won

10

Content Type

Profiles

Forums

Gallery

Blogs

Downloads

Wiki

Everything posted by ViperMan

-

Fair enough. I should educate myself on that. Yup. And here is what I'll say about that. A good government - one that is restrained to doing good and correct things for its citizens - has a (basically) fixed cost. If you accept that (which you probably don't), you would eventually be forced to conclude that a percent-based income tax is not the proper way to fund such a government, because you eventually get enough dough to pay for the services you need to provide, and taxing beyond that must, therefore, be done for other purposes. The tax system we have guarantees no upper bound on what the government can collect. That is strange. Our tax system's main purpose is to flatten peoples' quality of life - which is beyond fucked up. But that's what it's purpose is. Keep us working. Inflate the value of your past labor away. Make saving a sucker's game. Ensure that the productive keep producing just enough to sustain themselves and everyone else. Never let anyone reach the land of milk and honey. The only reason to tax citizens when you have a government that simultaneously prints the very money they tax is to generate demand for the currency, otherwise, just print what you need. Right? Or what do you think about that relationship? Austerity may be a fact of life if we don't get our spending under control. Economically, the planet is a closed system in an entropy sense. So if we print infinity dollars, the value of those dollars to the rest of the world will drop to zero. That is indisputable. And it also happens to be a major caveat to our position in the world. The reserve currency privilege is not a God-given right. It is maintained purely by the fact that other people in the world have faith that a dollar will buy something. That it is a store of value. A medium of exchange. Look to how much you think Franks were worth in the 20s and 30s. There are reasons why currencies plummet in value. We are subject to the same economic realities as everyone else, but we *act* as if we're not. This is the absolute most dangerous fact in American life right now: the idea that our position in the world is fixed.

-

Let me caveat this with my current understanding of VA compensation: I don't know anything about VA compensation. My opinion? Yes, probably. I see guys I work with who are 100% disabled and still fly F-16s. YGBFFFM. Seriously bro? In their defense, it's also been explained to me that "disability" is probably the wrong word to use to describe what's going on. Most people aren't disabled according to the MW definition of the word. The legalistic, lawyerly, VA definition of "disability" has more to do with how much damage you've sustained over a career. Fair enough. Back to my opinion. When someone who is able to claim 100% disability can still fly a 9G jet and stands next to someone who is 100% disabled who had all four limbs blown off in AFG, I think that's a bit sick, frankly. Something is wrong with the system.

-

The core problem in our society boils down to one thing - too many people have no skin in the game. It's reflected in this conversation right now. We are lamenting the 69 people who don't pay enough in taxes. Roger. I get that, and they should pay more than their 15% or whatever it is they're paying - it's a lot less than the 40-50% you and I pay. That said, there is far, far, far, faaaaaar greater moral and social consequence to the functioning of society when 50% of us pay nothing, or next to nothing. I'm not saying don't tax Elon, Jeff, and Bill more - at least to parity. But we absolutely *must* start charging people for what they consume. Want welfare benefits? Cool. Here's welfare and a 40-hour per week job filling up pot holes. The free lunch has to stop. Benefits have to go hand in hand with some sort of exchange of labor, long-term debt, or generational/familial accounting. Free has to end.

-

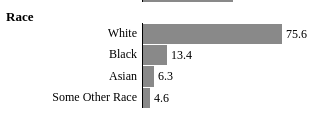

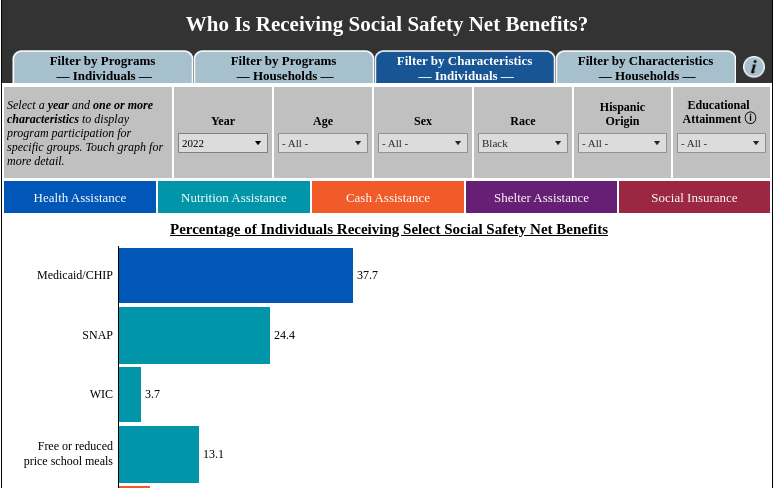

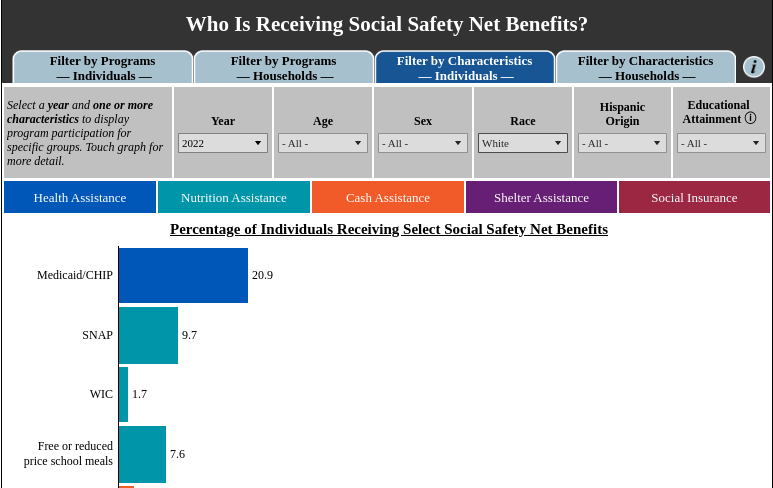

You're quoting a summary statistic that conveys information about groups who use any program and collecting it all underneath one metric. This incorporates social security. Which basically includes anyone who worked and paid taxes at some point in their lives. It's a bit of a stretch to consider SS under the same banner as food stamps, SNAP, WIC, or Section 8 benefits. Anyway, the more subsets you include in any statistic, the more it will display convergence towards the underlying population. So that's the literal, mathematical reason you're seeing that effect. The same exact site you provide allows you to answer your own question. If you select "Filter by Characteristics - Race" you'll be able to dig into the stats. For instance, you can see what @blueingreen is talking about if you look at WIC/SNAP by race: Section 8 benefits show a similar pattern. Effectively, you're missing examining the underlying populations, or stated differently, not restricting the data by subset.

-

Thanks. I see the error with NY. Sorry about that. Hopefully the underlying, broader point about the SALT redistributing Federal tax dollars to blue states isn't lost in the arithmetic. Estimates place approximately 14.4 million households in CA making between $80-120K. This puts the total redistribution to CA at $7.2 billion dollars per year (using a $500 net gain for CA per tax return) when compared to FL (currently). That amounts to about 2-3% of CA's annual budget. That number isn't on any accounting sheet. It's rough math, but the point is that there are hidden factors like this which distort how much individuals wind up paying to the federal government. At lower levels of income, the difference is exacerbated. Tax Comparison: California vs. New York vs. Arizona vs. Florida at $50,000 Income Category New York (NY) California (CA) Arizona (AZ) Florida (FL) State Income Tax Rate 5.85% + NYC tax 6.0% (on part of income) 2.5% 0% State Income Tax Owed ~$1,700 ~$1,200 ~$650 $0 Sales Tax (on $25K spending) ~$2,200 ~$2,200 ~$2,100 ~$1,750 Total SALT (State + Sales Tax Only) ~$3,900 ~$3,400 ~$2,750 ~$1,750 SALT Deduction Allowed (Cap) $3,900 $3,400 $2,750 $1,750 Disallowed SALT Deduction $0 $0 $0 $0 Taxable Income After SALT Deduction $46,100 $46,600 $47,250 $48,250 Federal Income Tax Owed (2024 Brackets) ~$4,800 ~$4,900 ~$5,000 ~$5,200 Total Taxes (State + Federal + Sales) ~$8,700 ~$8,500 ~$7,750 ~$6,950 Relative Federal Tax as % of Lowest State 100% 102.1% 104.2% 108.3% Here you can see a FL resident pays 8.3% more to Uncle Sam than a NY resident, and ~6% more than a CA resident. So really, the SALT is a way for blue states to redirect federal tax dollars into their coffers before that money shows up on any accounting sheet. In 2016, the average SALT deduction in CA was ~$18K. Multiplying this by 5.5 million returns puts the total deduction at about $100B. That's a redirection of about $25 billion dollars (in one year - before the SALT was capped) from the federal government to CA. In comparison, total tax receipts from the lowest 5 states in 2020 (4 red, 1 blue) was about $30 billion.

-

Do you mean besides the express, stated purpose of Prop 13? All kidding aside, if you think prop 13 has the effect it is supposed to have - namely, keeping people in their homes - then that's all the proof you need. If you want more data, I recommend this site: https://www.officialdata.org/ca-property-tax/ It will show you every property in CA and how much tax is paid on it yearly. You won't have to search around at all to find 10x differences in any given neighborhood. With some effort, you'll be able to find 100x differences. You can conduct your own thought experiment to determine whether or not someone who currently pays ~$1,000/yr in property taxes would be encouraged to sell their home and move if those same taxes went up to twenty or thirty thousand dollars/yr. Prop 13 aside, another dynamic that distorts the simplistic "blue states contribute more" meme is to consider is how the SALT functions. In short, it reduces blue states' contributions to the federal tax kitty relative to red states' contributions. Here is a table, courtesy of Chat GPT, that will show you how on an income of $100,000, equal earners who live in different states pay the federal government different amounts. Notably, if you live in a lower tax state (i.e. red America), you get the privilege of paying more for the federal government. If you live in FL for example, you pay 3.8% more effective federal tax than if you live in CA. You pay 3.0% more than if you live in NY. If you aren't a property owner, those differences increase even more. Tax Comparison: California vs. Arizona vs. Florida vs. New York at $100,000 Income Category California (CA) New York (NY) Arizona (AZ) Florida (FL) State Income Tax Rate 9.3% 5.85% + NYC tax 2.5% 0% State Income Tax Owed ~$4,450 ~$5,200 ~$2,500 $0 Property Tax (on $400K home) ~$3,000 ~$4,200 ~$2,000 ~$3,200 Sales Tax (on $35K spending) ~$3,100 ~$3,100 ~$2,900 ~$2,450 Total SALT (State + Property + Sales Tax) ~$10,550 ~$12,500 ~$7,400 ~$5,650 SALT Deduction Allowed (Cap) $10,000 $10,000 $7,400 $5,650 Disallowed SALT Deduction $550 $2,500 $0 $0 Taxable Income After SALT Cap $90,000 $90,500 $92,600 $94,350 Federal Income Tax Owed (2024 Brackets) ~$13,200 ~$13,300 ~$13,400 ~$13,700 Total Taxes (State + Federal + Property + Sales) ~$20,750 ~$21,800 ~$17,800 ~$19,350 Relative Federal Tax as % of Lowest State 100% 100.8% 101.5% 103.8%

-

Metrics like this mask more than they illuminate, especially when they are taken at face value. @blueingreen gave a good example. I won't make this another rant about prop 13, but it's another example of why stats like you provide - which inform your opinion - are bad basis upon which to make judgments about the world. Prop 13 functions to allow many people to live in CA who otherwise wouldn't be able to afford it. In other words, there are people whose federal tax contributions are counted in the CA column when they would really be residents displaced to NV, AZ, or elsewhere if CA's tax system wasn't so effed up. The two-pronged effect is to subtract federal tax contributions from other states and add them to CA - distorting the reality of the "red states receive more than they contribute" or at least complicating it. I'm certain many such distortions exist which shift the balance in both ways. But painting with a simple brush like "blue states contribute more to the tax kitty" is likely an artifact of other underlying distortions that are in operation which make it appear so. Extreme high earners, who pay the majority of income taxes, tend to live in big cities like Los Angeles and New York.

-

It's funny that I have the exact opposite opinion. Just as a matter of pure observation, it's interesting how some of these things break down along polar political lines. Anyway, here you go: RFK is on to something. He may be a bit off kilter on some issues such as Fluoride in the water and other fringe issues, but on others, like giving 69 vaccines to kids before they're 1, he probably has a couple of valid points. Also, just take your one each American citizen and put them on a scale. Now compare that to the same American in the 1950s. There is a difference, and it's not genetic. RFK is one of the few dems who is willing to say the emperor isn't wearing any clothes. He is pointing at something that is real and we can all put our hands on: our healthcare system and the way it functions is completely effed. It's driven by adverse incentive and no one is talking about it except for him! So he might not have all the solutions, but he has certainly identified a problem and it's an important conversation to start that we haven't been having. And finally, say whatever you will about his positions, he clearly has a deep level of knowledge about the domain. Tulsi, on the other hand, is decidedly not on to something. She's a confirmed and deranged conspiracy nut, and her tenure as DNI could potentially be catastrophic. Yes, everyone knows there are problems with our foreign policy. She offers no revelation there. But the USA is not out there sewing discord for some ulterior nefarious purpose, which is what her underlying view of the foreign policy establishment is. She's the type who sees Edward Snowden as a hero, rather than as a traitor - which she is on record as having a desire to see his charges dropped.

-

I'm sure the nuance of this will be lost on your one each lib, but Tricare is part of the total benefits package my employer - the US government - offered me in exchange for my labor. In no way, shape, or form is it "socialized."

-

Having little to no SA on the specifics here, I can say based on my experiences in the military and thus far in the civilian world, ATC is far too comfortable giving visual approaches to passenger aircraft. IMO, they should basically only be given upon request. I think it has become the easy button for them to place responsibility on pilots.

-

If you're basing your entire opinion of anything based on the fact that a "jury of his peers found him guilty," I know two things about you. You've never sat on a court martial or a jury, and two, you have very little practical knowledge of how the justice system works. If you had you would understand that many things - facts, relevant facts - are withheld from the jury. I know this - I learned this - because I once was part of the jury on a court martial in which the member was found guilty, and only after we rendered our verdict and sentence recommendation, were we allowed to be made aware of things which the defense and the prosecution argued about allowing us to know. Why does this matter? Well, we may have still found the member guilty, but I believe the punishment we meted out would have been significantly moderated. I hope you're never falsely accused of a crime. I hope you're never up against a DA or prosecutor that has an ax to grind. I hope that you're never in the wrong place at the wrong time or in the wrong circumstances. If you are, and you think that everything will be ok because the jury will just magically get it right since it's part of our constitutionally guaranteed set of rights, you had better reinterpret your threat environment, because juries absolutely can and do get it wrong. All. The. Time. Yes, a jury may have found him guilty. That is a fact. Whether or not he actually is guilty of the crime he was charged with is a separate question.

-

January 6th was a block party that got out of control. If you want to see an *actual* insurrection, you can look at the summer of 2020 when numerous democratic governments all but sanctioned mob violence in the name of social justice.

-

DEI is awful, and at the same time, I don't think it's directly responsible for this. That's just nonsense. Pulling back though, it is part of the larger, more dangerous, apathy that has taken hold in our country which says "competence doesn't matter and neither does accountability." Hopefully whoever is responsible for this is held accountable.

-

If wanting people to pay for what they use makes me guilty of not being conservative, then lock me up.

-

-

Initial Pilot Training and Future Pilot Training

ViperMan replied to LookieRookie's topic in General Discussion

Ah ok. -

Yes, you are right, but this take appears to be disingenuous. Of course there is no "mind" of the state of California, which you thankfully identify, but then immediately turn around and imbue it with agency and convey that it still disagrees with me :). My point was clear though: there are repeated efforts in California to address problems that prop 13 is creating. People, with minds, are aware of those issues. I brought it up because I think people on this message board would like to see how tax law and policy choices create weapons effects down stream. Hence the discussion. Yes. This is correct. My point is to illustrate one of the hidden effects of prop 13. CA residents can wonder "why don't we have enough infrastructure??? I pay so much in taxes." It's reasons like prop 13 which mask the "why" of not having enough money to buy infrastructure AND all their favorite social programs. I'm just pointing that out. Dickering over what spending should be focused on is a good (political) topic, but a separate one. I'm not commenting on whether or not CA 'needs' to increase their tax revenue - it is implicit that they do because their infrastructure has failed. That's true, prima facie. I may not like it, but it is plainly the case. You are right in stating that CA doesn't have enough money. That's what I'm pointing out. You're placing 100% of the blame on social program spending. That's part of the spend side and is a part of the problem. I'm pointing out that there is also a systematic collection problem on the other side of the equation, and also an interesting one that most people aren't aware of. You're categorically denying there is a collection problem. That's ok. Neither you or I like taxes. We don't have to be happy with every fact in the world. I'm as conservative as you are, but any objective analysis must start with looking at facts. Not with "democrats are stupid and wrong in all cases and all circumstances a priori and anyone who doesn't agree with me is henceforth a democrat." That style of thinking led dems to align themselves with all manner of absurdity when Trump would state something obviously true, just because they had to be the opposite. The question you present is framed in such a way as to side-step the issue and generate your pre-approved response. It hasn't got anything to do at all with what someone else paid for their home. Property taxes must cover the things we agree that property taxes must cover. If the cost of living in a neighborhood goes up because we need to run underground water pipes up the hillside in order to deliver water, that's going to be a cost borne by property taxes. I would argue that such a project should be shouldered equally, by all the people who are going to benefit from it. That is a conservative position. Prop 13 arrests that, which is why I think it's a problem. We don't "own" our homes in the same sense we own our cars or our furniture. I don't like that, and I'm not advocating for that, but for the purposes of this discussion, and the world we all inhabit, it is the case. So embarking on a diatribe for you and constructing an answer about why property taxes need to change over time is playing into a misframed argument. The price of a toilet flush changes over time. You know this. Everyone else in the world knows this. As that price changes, funds have to be raised to cover those increased costs. In contrast, wealth taxes are designed specifically to take from all assets as they are construed by Pocahontas, and their intent is confiscatory - that is a new thing as far as our country is concerned and is something that I am equally frightened to see we are flirting with. Property taxes serve a different purpose, and as long as any of us has existed, they have been part of the equation. Painting with such a broad brush intentionally muddies the water and conflates two separate issues. Funding things like infrastructure with property taxes is the choice we have collectively made as a society. Again, that's just a fact in the world, not an endorsement. We witnessed infrastructure collapse or at least not serve its function - ergo facto there is a problem there, maybe we should look at something. Hey prop 13 causes property taxes to function in a radically different way than in every other state, maybe that's part of our budget gap. Oooo, yeah, look, see here Bob, some people are paying only 1-2% of what other people are paying for all our infrastructure...maybe, just maybe, that's contributing to funding shortfalls, and could perhaps be the reason politicians have had to make trade-offs over the years and allow infrastructure projects to go unaddressed. That's all I'm saying. Constantly nudging the conversation back to all taxes are immoral, or at least property taxes in this case, is an interesting theoretical point, but not on topic. For the purposes of this discussion, they are a given. Not good or bad. Just a given.

-

Initial Pilot Training and Future Pilot Training

ViperMan replied to LookieRookie's topic in General Discussion

Ok, cool. So like Hertz rent-a-T6. -

Initial Pilot Training and Future Pilot Training

ViperMan replied to LookieRookie's topic in General Discussion

Liason program? Pre-positioning? Sorry, I'm not up to speed on all the COAs. What are these? I can assume I know what light foot prints at remote sites means. That could be interesting just because it opens up lots of options for people. Also, same with tenant units. Think beyond the USAF. Lots of good Coast Guard sites and Navy bases dudes would want to live near. Throw a couple of these out to K-bay, North Island, Tampa, C-Springs...now you're cooking with oil. Honestly, though, it probably makes the most sense to just stand up little tenant units near the super hubs, or within about 2 hours of them...at least the first ones if something like this actually goes down. -

@Lord Ratner I didn't open that line about prop 13 in order to convince you, personally, that the law is having the effects I outlined. The state of California knows it's a problem - as evidenced by their continual and repeated attempts to have it changed which recur, year after year after year. It is squarely in their sights. You or anyone else on this board doesn't need to take my word for it. State lawmakers know it was a poison pill they took in 1978 and are grappling with the deleterious effects on their governments. I provided a couple little links to show people how absolutely distorted the property tax burden truly is in CA, but if you care to, you can find manifold research on prop 13 which goes into the numerous other distortions it creates. People can do their own research and make up their own minds, and if they don't live in CA, they can click around their state assessor's website and see that their neighbors likely share a similar property tax burden. CA is uniquely different. That's the point. It's a one-off. The hyper-libertarian diversion you go down about there's no such thing as "under" collection as part of a deficit, I literally just can't make heads or tails of. Same with the "progressive" spaghetti you shotgun out. Your last post was a kaleidoscope; it was tough to keep up with what point you were making. What I got was the impression that you benefit from prop 13, but whatever. Again, I'm not advocating or disparaging taxes at a fundamental level. That's a separate discussion. Spending (output) - Taxes (collection) = Deficit (if negative) | Surplus (if positive) Spending is half the equation, as you stated. Taxes (collection) are the other half. Or what am I missing? I literally don't get it which is why I think you were more making an ideological point about the fundamental legality or morality of taxes and talking past my point, rather than to it. It was tangential to begin with, and which is part of the reason I think @brabus engaged you on a more fundamental "well how do you think we should fund the government at all?" line of questioning because that's how your reasoning comes across in that post. We can (and should) have a discussion about the morality or ethics of taxation. But I'll save that for the PHIL 101 thread. Right here and now, in the present day, taxes pay for things like roads, police, firemen, and other public services. I can bang my head against the wall on that topic, but it's not going to accomplish much good. Most people who are conservative (me) want the things we all use equally to be paid for equally. My home's toilets flush (on average) just as many times a day as a progressive's. Same with someone who is my neighbor. So no, I don't need to justify why someone shouldn't pay for services they are using. What it cost to flush a toilet in 1978 isn't what it costs now. Just because you got to go to Disneyland in 1982 for $17.50, doesn't mean you get to show up in 2025 and pay the same rate. Things change. It's the project of communists and socialists to hand out carve-outs and exceptions and "credits" to select groups of people. I only advocate for people paying for what they use. If it's something we all use equally, we all pay for it equally. That sounds pretty damn conservative / fair to me. If you can get Bernie Sanders on board with that, I'll buy you a drink of your choice, but I think you've got your work cut out for you. Prop 13 ensures that the opposite of that happens, and it ensures it into perpetuity. The reason I brought it up, was because I like to get at the root cause of why something is happening. This message board is one of the better out there I've found because the mix of problem-solving, bar-napkin analysis, and trolling is tolerable. It's fun and partisan to score points dunking on Gavin Newsome and Karen Bass (and other "progressives"), but these are like "contributing factors" at this stage of failure. They are inept, corrupt, and I have no doubt share some responsibility for what happened. But, we're basically witnessing an infrastructure collapse which is a much bigger problem than can be solved by just pinning it all on one or two politicians, or even a whole political party. On the flip side of that coin, we can go full libertarian "you can't tax me bro! this muh house 'til the heat death of the universe" but we don't live in that world. This is a system level failure. That's why I pointed at prop 13. It goes back a long time - almost 50 years - and it informs the discussion at the "mission planning" level of analysis. Effects like this are baked-in. And we're not likely done dealing with the massive distortions laws like this create. Prop 13 is only one of many bad laws on the books. It's probably not the only policy CA has had in place over the long term that creates and contributes to issues like this, but it is certainly one of them.

-

Initial Pilot Training and Future Pilot Training

ViperMan replied to LookieRookie's topic in General Discussion

I would do it. Or I would do something like it. In fact, I am currently looking for a "retirement" gig that will let me keep doing military aviation in a part time capacity. I'm figuring out how to min run the airlines, and am winding up with a lot of free time on my hands. May as well do what I like, get paid retirement, get paid min guarantee, and then make extra money chasing clouds. That said, I'm aware of things like Drachen, etc. I also don't want to fly perma red air. For some reason I'd rather do something IFF-like or straight UPT. Maybe I'm crazy. Not gonna be able to do the part time (non-retired) gig after I'm retirement eligible - I just can't make working for free make financial sense. -

You didn't respond to the point I'm making though. I'm not disputing these things: Property tax may be an unethical manner for states to tax inhabitants - I have not challenged this in my previous post. California (and most other governments) absolutely misallocate their funds on social projects, climate "justice," saving the fish/squirrels, et al. They do this to the massive detriment of other, more important spending - like infrastructure. So on those topics we can agree - or at least not disagree directly. No, my point is that prop 13 has been a boon for certain property owners to the detriment of others, which is why it has become so entrenched. And the unintentional side effect of this has been to create a massive deficit in CA's budget, one which is mostly hidden, because people who don't live there don't understand how CA's unique property tax exclusions work. And others don't understand how much more expensive it would be to live there if tax burdens were equalized. For instance, take two properties and compare them side-by-side. They're neighbors in San Francisco. 45 Liberty 23 Liberty Google street view If you compare them on google maps, you'll see they're effectively the same property. One of them pays a yearly tithe to the state of $50,400. The other pays a yearly tithe of $1,800. That differential, of $48,600, accumulates over time, but it never shows up on any balance sheet. This is the actual, real, deficit I'm talking about. In the next 10 years it'll amount to a half a million dollars (more with interest) - and that's just between two neighboring properties. The aggregate effect of this massive, marginal under-taxation, is to generate insurmountable, unimaginable debts. I bet if you integrated a function like that, the total, hidden, debt would be in the hundreds of billions, even trillions of dollars over the last number of decades. These are the type of debts that insurance companies can't pay. The type of debts that lead to increased insurance premiums for people who don't even live in California. The type of debts that lead to the cost of eggs tripling and people wondering 'why'. The type of debts that lead cities and towns to make system level choices when it comes to allowing their infrastructure to collapse. The type of debts that bankrupt states. In essence, CA has been writing checks its politicians couldn't cash. Yes, CA budgets their money incorrectly. It is also true that prop 13 has turned the state into a real estate cartel. One in which long-term owners are the ones pocketing property taxes that would otherwise go to fund the state's infrastructure, or would otherwise operate to prevent people who live in CA currently from living there because they can't afford its actually cost thereby preventing the debt from accumulating in the first place. // Break // I am not arguing that taxes need to increase in CA. I am not arguing that property taxes are fundamentally 'fair' or 'unfair'. Those are separate discussions. I'm pointing out that the property tax system in CA is fundamentally and uniquely different than in every other state I'm aware of wherein people who own similar properties pay massively different (10X or sometimes 100X) tax bills. See the above for proof. So no, prop 13 is not ethical - it's one of the most insidious, discriminatory, and unethical laws in operation in our society, and we're witnessing it bear fruit right now. But because it has complex, hidden effects, grants certain people massive (and legal) $ arbitrage, it's simultaneously a very easy law whose effects are easy to obfuscate and also one that gets a lot of people to stand in defense of because they benefit from it directly. It's also a reason I scoff when people say that CA contributes more to the federal tax base than any other state. Yeah, right, so long as you ignore the enormous hole they dig themselves deeper and deeper into year after year by passing and keeping laws like prop 13.

-

I don't disagree, but focusing on what's listed on paper is missing the point. I'm sure if I looked through their books the majority of their expenditures would be misallocated. That doesn't address the collection problem, however, or the actual deficit that is reflected in the way this disaster has unfolded. Much of CA's property tax base winds up in the pockets of private owners due to prop 13. No other state I'm aware of has a property tax policy which directly and systematically under funds their government quite like this one does. That has consequences over the long run - ones we are seeing right now. The point I was making was more along the lines that if you design a tax policy around not collecting taxes from the people that live in your state, you're going to eventually run into the consequences of said tax policy. In this case I'm just pointing at prop 13 as having the largest / outsize impact on creating a massive accumulated deficit CA has avoided contending with. They may have had a "surplus" on paper for numerous years. Maybe now they have a "deficit." Politicians may have touted said surplus and maybe even some of them felt pretty good about themselves and got some kudos from their voter base. I bet it felt good to them. Maybe they had a $100 Bajillion dollars surplus in their Excel sheets or PowerPoint slides. Cool. It's an illusion. It's a number on a piece of paper. It means absolutely nothing. Reality keeps the actual balance sheet. The truth is that there is a real, actual, physical, literal deficit buried in the ground, reflected by their crumbling infrastructure, empty reservoirs, ineffectual government, understaffed agencies, man-made drought due to policy choices favoring industries over citizenry, etc, etc. It took many 10s of years to create a problem this big. Running California properly costs a lot more than they spend. Too many people live there who "tax" the system without paying into it. That's what I'm talking about. That's the deficit that builds and builds over decades due to tax policy like prop 13 and which allows the party to continue right up until the balcony collapses. This is that kind of deficit. Or, if you like, you can look at it like this: all the insurance money and construction costs that are going to be incurred over the next number of years "rebuilding" CA was the actual deficit they weren't carrying on the books. At a minimum. Now start doing that math on all the other mismanaged forest or grassland in CA that's all still waiting to go up in smoke. You'll start to get an idea about how far behind they truly are. *Note: nothing in this post should be construed as desire to increase taxes on "us" - we all pay too much as it is.