Random Guy

Registered User-

Posts

142 -

Joined

-

Last visited

Content Type

Profiles

Forums

Gallery

Blogs

Downloads

Wiki

Everything posted by Random Guy

-

Everyone just be glad they don't own property in Canada:

-

Nothing about liberalism is compassionate. Treating individuals as labour inputs cannot be compassionate given basic properties of a human being, like family, community. CA purposefully under supplies housing because they don't want to live in a populated area. They don't want coastal CA to be like Hong Kong. If you mean that low interest rates drives up housing prices--yes, it does. But ultimately banks create the money they issue to home buyers, so house prices reflect whatever banks are willing to create. That's accounting convention--houses are priced according to comparables rather than some other metric, which produces a pro-cyclical dynamic: the more banks lend, prices go up, the more collateral prices go up, the more banks can justify creating money (larger loans). When the income of households fails to cover the interest burden, households take on short term debt to pay off their interest burden, which makes the system more susceptible to short term changes in interest rates. But the bubble dynamics of housing are much more complicated than that today, because the financial instruments themselves (MBS) serve as collateral for other money creation. A house of cards within a house of cards within a house of cards. This is why the Fed has placed itself in as a dealer in money markets via the Standing Repo Facility and Bond Purchasing program. Its has woven a web of interrelated debt structures which everything depends on but can't sustain itself. This is why @Lord Ratner is talking about there being 'too much debt', which is generally correct but an oversimplification--the wrong kind of debt (the wrong kind of money). Debt is money. You can't just reduce debt, that reduces money--the deficit reduction we see happening now may reduce the money supply far below the required amount needed to sustain the private debt structure.

-

-

I think people misunderstand that CA natives don't want people moving there, and they use their legal system to intentionally restrict housing, driving up home prices to increase their own wealth, and make the people moving to the state miserable in the hopes they will some day go home. And it's working, inflow to CA was negative for the first time last year. Honestly, CA natives just want to go back to a state of 1900's rural beach property and empty land.

-

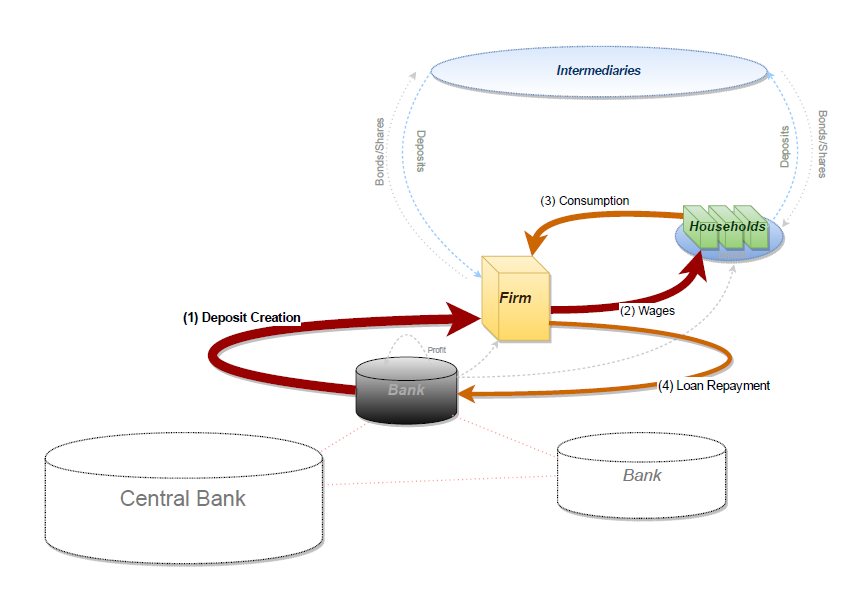

What is a mother paid for her product, the child itself? Nothing. Keep in mind that this output is the source of all future output, but women aren't compensated for it. Mothers are not paid for that labour. Do you pay your wife a wage, according to a contract, and does she negotiate her wages with you, subject to terms of law? This is not a reference to the southern US. Slave economies were the basis of social organization for thousands of years, beginning before the Sumerians themselves. This is our point of contention--if banks do not print dollars, where does money come from? Who/what creates the money supply today? What is the process? This is classical monetary inflation (too much money chasing too few goods) and this was refuted by the Fed. Inflation is not just a monetary phenomenon, and supply is not the only factor contributing to price changes. The paper is linked earlier. The platinum coin denominated as $1T would be produced by the mint and purchased by the Fed. The Fed would mark up the TGA by $1T and put the coin in a glass case on the wall. This is Rohan Grey's PhD paper, the source of this discussion topic, it's worth a read. Not sure how this relates to the financial system as it exists today. Similarly I don't think this would pass for a sufficient explanation of an aircraft system today either. Yes. The bank balance sheet expands, liabilities are created, those liabilities can be used for making payments. A loan is a legal contract, and exists within a legal system. All the effects and dynamics of law apply. The underlying collateral, if there is any, as private property, rights to use of property, all are affected. The IMF makes lots of dollar denominated loans to states that can't create dollars except through exports or asset sales that it knows won't be repaid, those loans have binding legal properties which are then wrought upon the debtor state--and that debtor cannot call the IMF and say 'hey, this isn't a loan sorry'. The US Gov won't 'pay back the debt', because in accounting terms that doesn't make sense. So long as someone has a desire to save, separate of the desires or behaviour of the private sector, the gov is the only entity which can swap an interest bearing note for those deposits. This is covered in detail via the animated slideshow linked earlier in the thread (screenshot above). If we trace the unit of currency through the financial system, the answer to your question becomes self-evident. You don't have to hear it from me. Here I think you mean that liabilities are being created and the corresponding asset has no market value. Or, in the case where the bank has positive equity, it can write liabilities to its ledger and create money--its not purchasing a loan contract from a borrower, its using the empty space on its balance sheet created from past loans and other loans (assets) currently on its books. Indeed, the deferred asset the Fed is creating right now demonstrates that money does not always need to be a loan, the Fed is just marking up its liabilities and assets without any contractual obligation applied to any human being. It's literally risk-free money for banks created from nothing. If you repay all loans, right now, using existing deposits, what happens to the money supply?

-

But I'm not sure you and I are using the word Liberalism the same way.

-

@Boomer6 If you don't like one of my posts my feelings will be hurt. 🤣

-

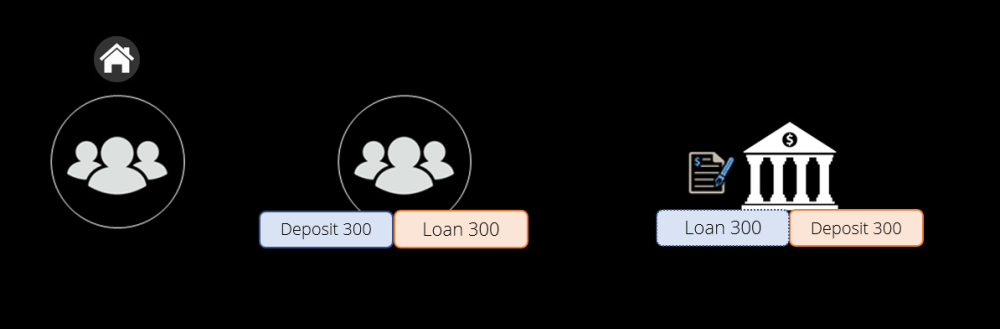

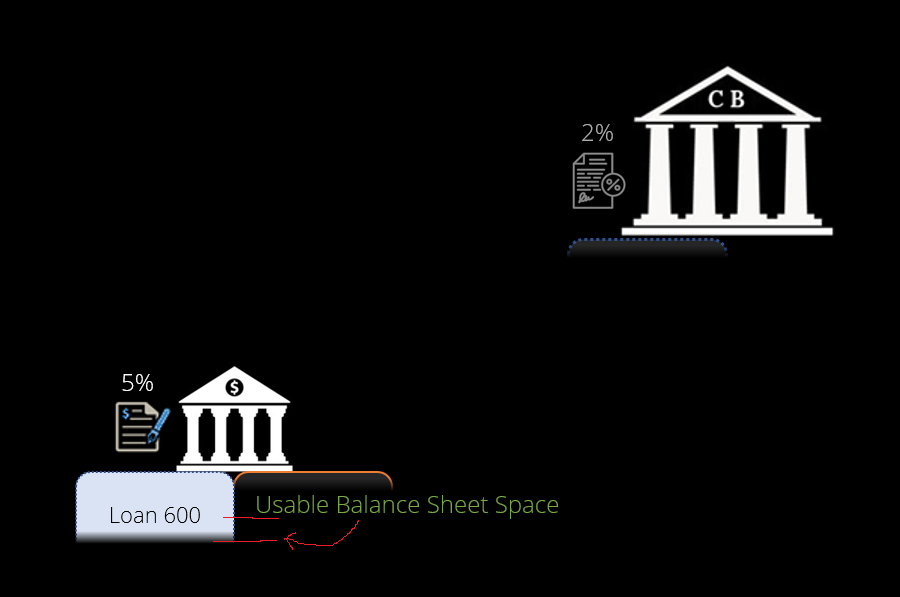

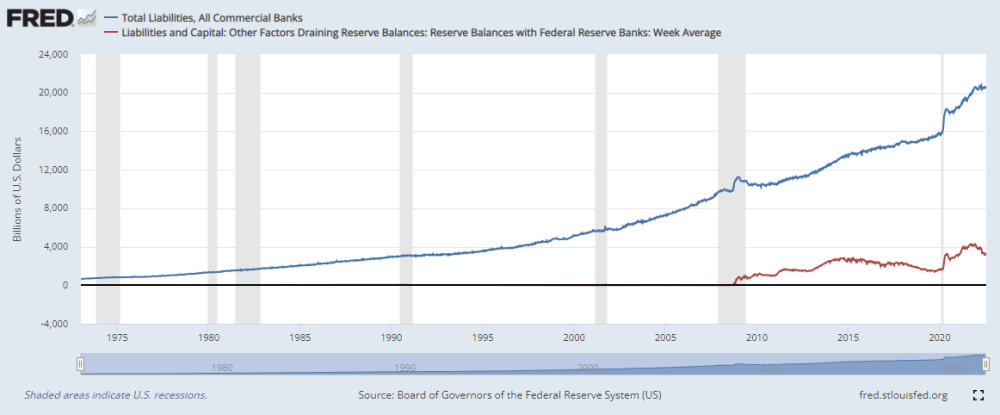

The Fed has a mandate to control prices, but asset prices aren't included in that mandate. The Fed inflates asset prices, intentionally. Again, I'm not saying the Fed is good or bad, I'm trying to get at a good description of money creation in order to trace its path through the system, we're just trying to identify where the fuel comes from in the first place. And the Fed is one component of money creation, when it marks up the accounts of its account holders, who are banks. The private banks themselves create most of the money supply. Ok, here is a claim we can test. When a bank issues a loan, such as an investment bank, it would be interested in recouping the loan [principle + interest (risk) + inflation (expected)]. So any bank loan (money creation) would have included in it an adjustment for the inflation associated with not just this loan, but all loans, over the respective period of time. Is this adjustment for the change in total private bank lending over time (typically referred to as a 'credit impulse') reflected in bank loan documentation? Not that I am aware of. We can also look at the change to CPI or CPI + asset prices when defaults rise, because defaulting loans means that the corresponding destroyed money is never destroyed. During periods of cascading defaults (firesales) does the CPI or asset prices rise? No, typically both decrease. Next we can think about it from the perspective of a single loan for a business that purchases only labour, a single 'monetary circuit' (Graziani, pictured below). #1, the bank creates deposits for the firm, #2 the firm pays workers... [If all money is always inflationary, are workers wages rising? The wage contract is typically agreed to and fixed prior to payment]... #3 Workers buy and consume the output... [If all money is inflationary, are the prices for the produced goods increasing? I don't believe so, firms typically set prices equal to costs plus a markup and don't respond to immediate changes in demand. Plus, any inrease in prices means an inrease in inventory, which would mean losses for the firm and default because the workers don't have enough money to pay increasing prices for the output, they would need additional loans from the bank]... #4 The firm repays the loan destroying the money created by the bank. Where in this circuit are prices changing because 'all money is always inflationary'? Please see the chart I posted above, which shows the response of CPI to Fed QE operations (no correlation). I agree that the Fed causes a change in lending behaviour, and you are spot on about that increasing 'moral hazard' and potentially 'misallocating resources', and that the asset price inflation will likely reverse if the Fed attempts to unwind QE which is happening now. These are valid points--and I'm not trying to antagonize you, I like your analysis--but I want to purge from it a reliance upon commodity money first and foremost. Banks create money, gov and private banks, and they are the decision makers about where the path of our economy leads (what we make, what we consume, where its made, etc). And this is not neutral <-- not just some function of the highest rates of perceived return, but subjective decisions of imperfect people with power. I don't understand what you are trying to convey here. When I purchase milk at the store, I am receiving productivity because I am paying with money. But if someone gives me the same milk, I am not receiving productivity because no money is involved? In the case of 2LT copypaster the increase in productivity doesn't do anything to the price for his labour. His wages don't go down as a result of his productivity increase. Regardless, we don't need a theory of prices or inflation in order to trace a unit of currency through the financial system. We only need to agree on the origin and substance of money in the real world, which today comes from a bank and resides on bank ledgers digitally. Well, the Fed is not authorized politically to disburse deposits to households. They are fully aware of the impact of QE on asset prices, that was Bernanke's stated intention ('wealth effects'). But at the very least your statement here is agreement that bank money creation is not always inflationary--in the case of QE an equal amount of reserves was not destroyed, the Fed added reserves and has not taken them out yet. I think you must concede this point, and I will re-reference this chart, which shows Fed QE yoy change correlation with CPI change (no correlation of Fed printing to CPI): COVID reduced productivity, and reduced (constrained) supply through unforeseen bottlenecks, which has contributed to inflation in goods and services. The impact on globalization is unclear, but your speculation may be correct. But the 'irresponsible money printing' here is unclear--all money is printed, what makes some money responsible and some irresponsible? Again, genuine question, and keep in mind that banks regularly create money for increasing future output, in other words, that output doesn't exist today for purchase. And this is where I want to get to. Neoclassical economists do not have an empirically valid theory of inflation. Post-Keynesians do. And I posted about this earlier in the thread--the Fed paper which acknowledged Post-Keynesian theories of inflation and money. When we say that the central authority doesn't understand--THEY DO UNDERSTAND. They just want something very different from you, and they are getting what they want. Not just too much debt, too much debt which won't be repaid--unproductive debt. And, a big part of that is housing debt. Any debt which does not increase income is technically considered unproductive. All mortgage debt, consumer debt, is by that definition unproductive. Remember, when you say 'Keynesian' you are specifically referring to the school known as 'New Keynesianism', which isn't based on the works of Keynes! It's based largely on the work of Hick's and Solow, and known as Neoliberalism, a resurgence of classical economic ideas from the 18th century. The idea that money is an exogenous commodity. F--- the academics mate. Private debt levels and repayment capacity of constrained balance sheets matters. That's the point of all this. Everyone here needs to know how the system actually works. Trace the drop of fuel through the machine, trace the unit of bank money from creation to destruction--that way people can decide for themselves what policy is the best way forward.

-

Ok, we're approaching our target I think. Taxpayer money, government spending beyond its means. Inflation, energy reliance/inflation. Remember, I live in the EU, so I don't really care what domestic policies AOC (or anyone else) is proposing, it doesn't affect me. What I am trying to figure out is why people in the US are shouting the equivalent of 'Your my fav big booty Latina' over and over to one another, rather than holding a useful dialogue and trying to form a team. What are the real differences that are dividing people? Can you get a cross-dressing faggot and a gun-toting redneck onto the same team? What policies would that team be based on? Can a decentralized framework of 'live and let live given large open undeveloped geographic space' work? Or is it that we need to purge a large group of people in fire first, and there really is no alternative? This leads us to prices--and we should really be over in the Finance thread, but I'll leave it here for now. First off, oil companies love high oil prices. US shale oil requires higher unit prices than almost anyone else, because the oil is more costly to extract. If you reduce oil prices below their costs, they close those wells. Generally, you need prices to be stable, and the Fed just gave the Dept of Energy to ability to act as 'shock absorber' via the futures market, guaranteeing future prices for oil producers. This ensures wells stay open and are less subject to speculative attack from outsiders like OPEC. Regarding Europe--remember that the US produces too much oil for its domestic market, and part of the conflict in Ukraine is about pushing the EU from Russian oil onto US natural gas. In other words, the US needs markets to sell its oil products, or the price of domestic oil crashes and the gov must absorb huge amounts via stockpiles (assuming it wants to keep domestic wells open). EU energy independence is bad for the US. More importantly however, is that energy transition to other sources (whatever they may be) requires energy. So exisiting energy production isn't going anywhere. What is going to have to change is the total level of consumption--we need to shift energy use from what we do now towards producing more energy sources that don't create GHG. If you don't think climate change is a thing, then you can ignore this (YOLO) and spend on something else. If you don't want the gov to spend on anything at all, do that. But this bring us to the actual topic at the heart of disagreement I think: HOW DO WE PAY FOR THINGS. And people get really worked up about this. But bankers don't. Bankers know they can always fund anything so long as the resources are available for purchase.

-

YES, homelessness in democratically controlled regions, such as California and Washington State, and large cities like SF, Portland, and Seattle have serious problems with inequality, employment, and asset prices. This is what [economic] liberalism produces. We are seeing the conclusion of 40 years of liberal [economic] policy pursued by both parties.

-

Note I didn't say the system wasn't flawed. We can trace a drop of fuel through an engine without saying whether or not the engine is flawed. All systems are flawed, that's called entropy 😄. Whether or not its good or bad is another thing entirely. Whether or not the Fed and private banks can create money is different than money's effect on prices. Clearly, we can identify that banks create lots of money, and some of it is inflationary, and, some of the inflation falls into categories that people ignore (ex: asset price inflation, no one complains that house & stock prices are rising to the degree that gas prices are). Here is a chart showing the balance of Fed purchases (increase in gov money) relative to the US CPI: Money cannot be a 'proxy' for human output, because lots of human output, especially in services, is non-monetary in nature (ex: a mother's work producing children). Or, imagine a slave economy, where all output is produced by slaves and consumed by slave-holders, and that output has no price. The quantity of money and the quantity of output would be irrelevant to one another. Can we agree that banks are the source of money? Private and public banks are money creators, and this occurs when banks issue loans? I want to know where else money comes from, if this is not the only source.

-

The purpose here is to learn about financial systems, reconnect folks' instruments panels, so to speak. First, private banks do lend unsecured. But I don't follow your argument that private money creation is never inflationary, but gov money creation is always inflationary. In the case of Fed QE, inflation for consumer goods was low from 2008-2020, yet Fed money creation was quite large. QE supports asset price inflation. The gov spending from 2020-2022, on the other hand, was directed towards goods and services, and we see an associated increase in consumer goods inflation. Wages are muted, profit margins have increased. In effect this was gov transfer to businesses in the form of profits. But this is getting quite into specifics when you haven't quite nailed down clearly for me what money is and is not. I'm not here to argue the merits of MMT, whatever you think that is. I'm here to discuss operations and dynamics of financial systems and money. MMT is largely about policy, and I leave policy up to each of you. We can reconnect your instrument panel, what you do with the jet is your choice. It seems as though you have swapped one word, money, which you don't have a concrete understanding of, for another word, productivity, in an effort to escape the investigative spotlight. So, I'll ask you define your new term, what is 'productivity'? And, let's get specific, imagine a town without money (common in the anthropological record, ~4000BC time frame, middle east). A group of folks living together who go about their day as a team, assigning tasks according to a hierarchy, and living without any monetary constructs to allocate labour or other resources. They eat mostly barley, have simple tools. Is productivity present in this setting? In the context of productivity being any increase in outputs for any given combination of inputs, the exchange of 'money' is irrelevant to the technology used by the folks in town, isn't it? If a member of this team organizes the digging of irrigation ditches to increase crop output, does money somehow magically appear, agreed to by everyone of the team, to facilitate an exchange of labour for an increased crop at harvest time? Why? Or, imagine your younger self (instead of the Sumer example). Brand new 2LT, copying and pasting data from one document to another. Your wage is fixed. You discover "Ctrl + C, Ctrl + V", increasing your data transfer productivity 2x. Does this create money? Does it require money in order for you to learn something new? Are children not learning because they aren't paid or because insufficient money exists in circulation elsewhere? What would be an example of misdirected or negative productivity changing a quantity of money or the capacity to create money of a money creator like a bank?

-

Which ideas, can you list a few? When you say 'The economy will tank in 5 years', can you be specific about what that means? Ex: unemployment is 8-9%, stagnant or decreasing [real] wages, increasing reliance on imports, reduced mortality and birth rates, ?

-

Ok, just to be clear, the listed policies that you disagree with do not have any personal impact on you. Do you want to prevent someone who lives at a distance from you from creating policies relevant to their community, in other words, impose your will upon them?

-

Which part is pedantic, can you elaborate?

-

Before someone posts "Yeah, but the gov is giving people money", or "When the gov spends its inflationary". Private banks do the exact same thing. Credit cards are loans for consumption, banks create the deposits from nothing. Home mortgages (makes up ~50% of total money in the US economy) are unproductive, houses don't produce goods and services for the public. Margin debt, for stock trading, that's fresh deposits created by banks from nothing for speculating on stocks. The big difference we see if that private banks have created huge amounts money, printed money, and directed it towards housing and stock purchases. Which caused asset price inflation. But people don't consider this 'inflation', when it is.

-

All money is 'printed'. Whether its the Bureau for Engraving and Printing (which creates cash, a Fed liability), the Mint (coins, a Fed liability), the Fed's ledger (digital reserve deposits, a Fed liability), or the Treasury (US Treasuries aka money market collateral, a Treasury liability). We think that this stuff is money, but 97% of money is private. Created by private banks. And there is no other money. So what's different between the Fed (a bank) creating a loan to buy a financial asset, and Wells Fargo creating a loan via a credit card for you to buy a financial asset? We can replace what we're buying, rather than a financial asset, we could buy an airplane (F-35 vs a Boeing commercial aircraft), pay employees (gov payroll, firm payroll financed via commercial paper), etc. The action is identical, the purchase equivalent--but your belief is that one is printing money, but the other is not. When in fact they are the same. All money is 'printed' by banks.

-

Just saw your edit ViperMan, and I'm replying in this thread given the subject. So I can clear up this confusion, if you'll bear with me. Even if it sounds crazy, gyro tumbling crazy. When you object to money being printed, is it clear in your mind what exactly money is in that scenario? In other words, when money isn't printed, where does it come from, where is it kept, what is it? In the second quote (Lord Ratners'), we must ask ourselves: when money does exist for the gov to spend, where and what is it? Because we can imagine the Treasury General Account (TGA) at the Federal Reserve as having a positive balance (this is the checking account of the Treasury, just like our checking account at a bank). If that account is empty, so to speak, 'money doesn't exist' for the gov to spend. But the Fed can always mark up the TGA, like it did during Covid or right now. So if the account can be set to whatever value we choose, what does it mean for 'money to exist' or 'not exist'?

-

Thanks for sharing. If you have more to add, please do. I see 3 distinct groupings of information you shared, the first is clear policies you are against, the second is not exactly policy (maybe you can clarify here?), and the third is an expression of anger. My question to you would be, how do the policies you listed (#1) negatively affect you personally? And, what policies do you support instead of each of the points you listed in section #1?

-

The deferred asset the Fed is creating as we type demonstrates that money is not an exogenous commodity, like gold. The Fed can write a liability to its ledger and is only constrained by the political rules we define for it. The Fed doesn't have to purchase private assets, like bank loans, in order to create reserve deposits. This money is not preexisting, and someone makes the determination of who will receive that money, in this case banks. And money is what allocates all resources--which means that there is a strict hierarchy created at the moment money is created.

-

I can break it into two parts to help you read it. Neoclassical econ asserts that money is exogenous, like a lump of gold that produces X coins (we won't get into medieval coinage), or the gov creating Y bank notes (we won't get into the creation of the BoE). Given some constant exogenous lump of money, the set of available projects at a given time determines where that money will flow as investment. The individuals who hold it (savers) always want to maximize their return (individuals are utility maximizers with insatiable wants, and have all available info on all projects at any moment all the time). There is a natural rate of interest, like a natural law, according to the available technology (which defines labour productivity). So, in this fantasy world money flows towards projects according to these natural features, the money can't go anywhere else. Its powerless. Exogenous money is critical to this vision. People save money (collect it) then invest it, investment determines capital, which determines total amount produced. In this interpretation, there is one good (like corn), which is consumed, invested, and used as money. The problem is if money isn't exogenous, what changes?

-

I don't want to troll anyone. I'm sure you're a good dude in real life, as we all are. We're just talking economics and politics, we may be opinionated at times, and disagree, and there's nothing wrong with that.

-

No worries dude, I can go it alone. @Lord Ratner?

-

@ViperMan Not being cagey at all. It's a fair question to you, 'What part is MMT?' Specifically--I want to know your level of knowledge, what makes something 'MMT', how do you know? In this thread I've posted an MMT source, a response by Bill Mitchel, which is just a current event for folks interested in current economic news. The rest is entirely Post-Keynesian and official gov sources, such as the Fed and the Bank of England (central banks themselves). I've specifically avoided MMT sources because of the political antagonism between US Republicans and MMT'ers in the US progressive party, given most folks here aren't US progressives and were taught Neoclassical Econ. I don't need MMT sources to describe the financial system, and I'm not advocating policy (excluding our earlier discussion of "Favorite Big Booty Latinas"). If you agree tracing a drop of fuel through a jet is a valid exercise to understand reality, you cannot be against tracing a unit of currency through the financial system to understand reality--assuming you accept that money is at the core of our economic system <-- I presume you accept that premise. Edit: But yes, its fitting that a billionaire wants you to believe that money doesn't make him powerful. Money has 'no power in and of itself'. Musk is powerless. 😄

-

Which part is 'MMT'? Edit: @ViperMan consider for a moment an analogy: tracing a drop of fuel through an aircraft. There is no ideological wizardry in understanding how the machine works, so long as our description of that machine matches reality, would you agree or disagree with that statement?