Everything posted by Random Guy

-

The Russian Conundrum

Well, it's a matter of if they have sufficient power to impose that condition on the population, not whether it's is desirable or not from the population's perspective. They will likely have sufficient power to successfully implement it, as the neoliberals hold the majority in both parties.

-

The Russian Conundrum

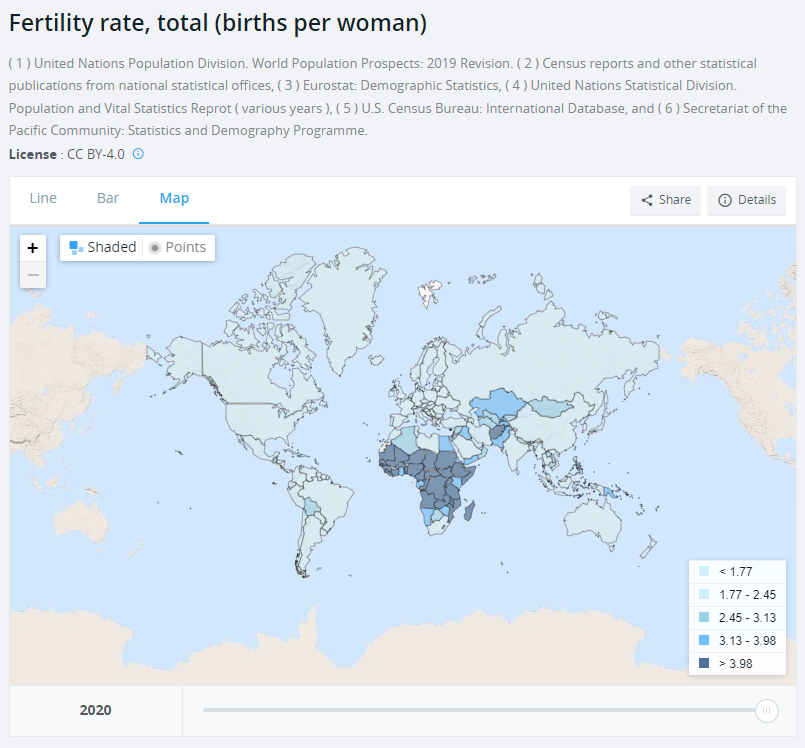

I'm hesitant to go there but... let's tie these threads together (abortion, demographics) in the spirit of that guy's wacky briefing. Sometimes, when you talk with family offices or HNWI in New York, you will hear discussion of demographics and a need to increase the total number of balance sheets (people) who can take on debt, as that debt is required to sustain asset prices and consume real output produced. One of the subjects that has been talked about over the past 5-8 years is banning abortion & birth control. [economic] Liberals, aka Neoliberals, in both parties, are fearful of a world of negative population growth rates, as it can unwind asset prices and reduce relative power of asset holders (empty houses aren't worth anything, and, having spent 40 years moving households from gov retirement guarantees to private investment retirement plans which siphon management fees, households are reliant upon asset prices not falling to sustain consumption in old age). We need to 'recreate birth rates currently seen in Africa, which means reducing access to birth control and abortion', paraphrasing. This means an increase to population would occur in tandem with decreasing wages, that is, an overall increase in total output and productivity but a decrease in quality of life for all households (more children, more work, but less income, as household negotiation power is crippled by Fed wage inflation targeting +asset price backstops, and active gov support for anti-union and pro-monopoly policies). In such a world (!), as an asset holder, you want your local protectors of your accumulated private property (police) to be very well armed (ex: MRAPs).

-

The Russian Conundrum

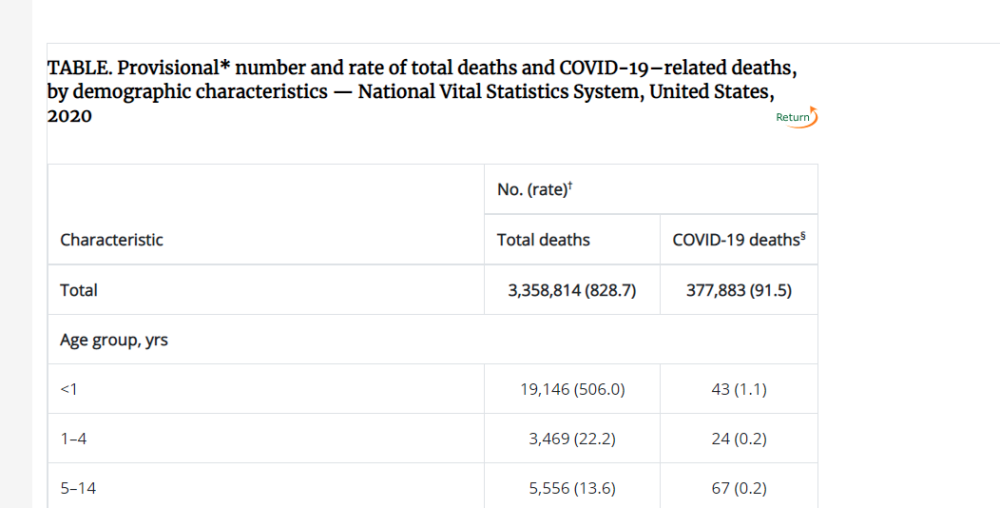

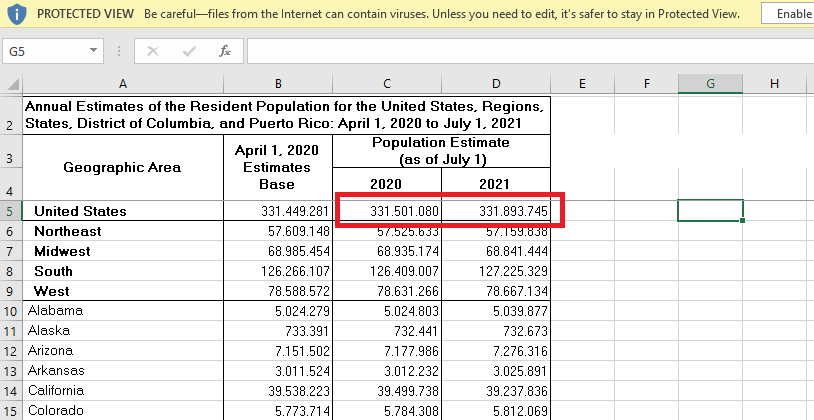

Using the CDC, the total deaths for 2020 was 3.358M vs 3.605M briths, correct? A difference of about 250k excluding net migration (0.07% pop increase)? So, with net migration (~500k) total pop increase of about 750k? https://www.cdc.gov/mmwr/volumes/70/wr/mm7014e1.htm

-

The Russian Conundrum

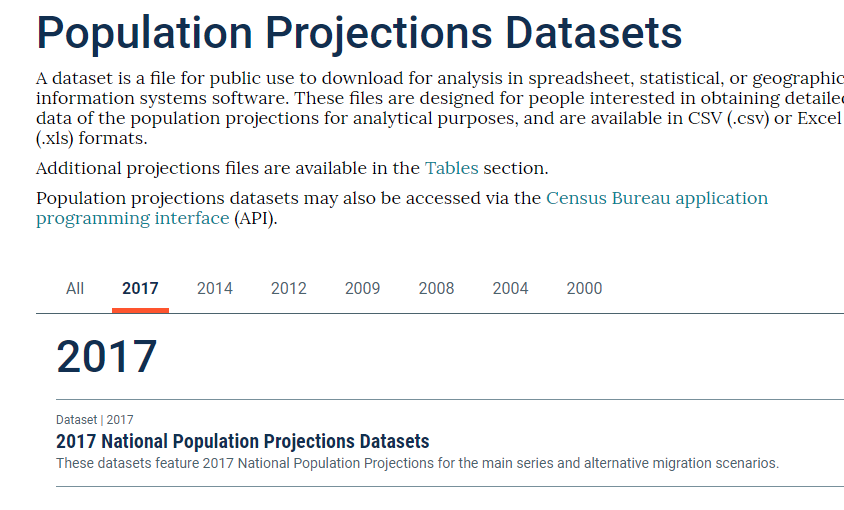

Where are you getting your data from? Doesn't the latest US Census data show the 2020 - 2021 total population change at ~400k? https://www.census.gov/data/datasets/time-series/demo/popest/2020s-national-total.html And the projection dataset is from 2017, is that correct?

-

Money and Finance

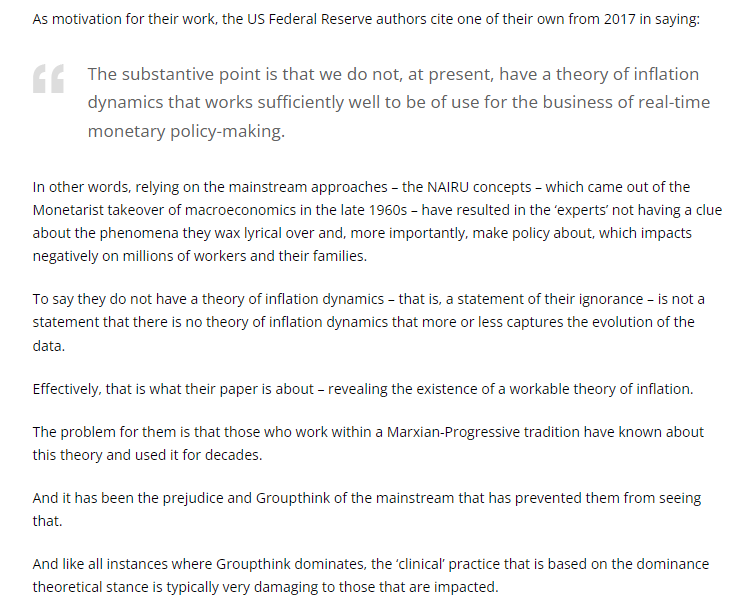

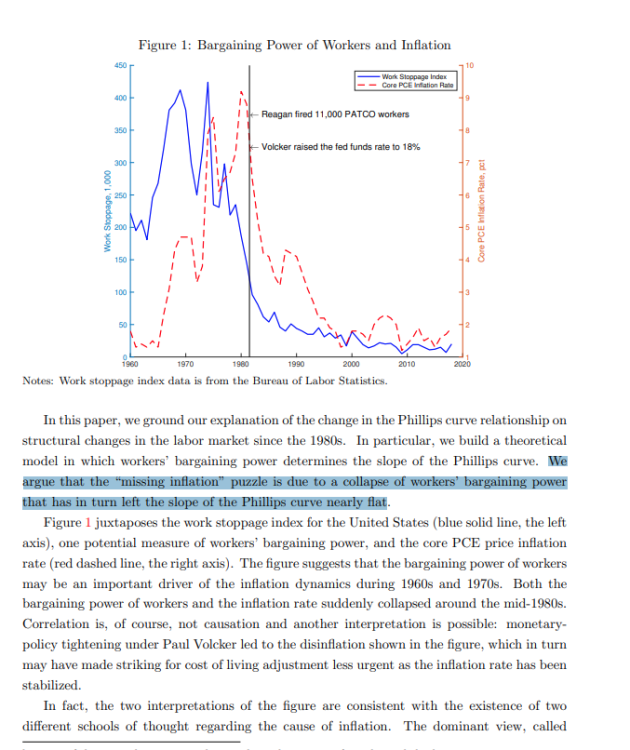

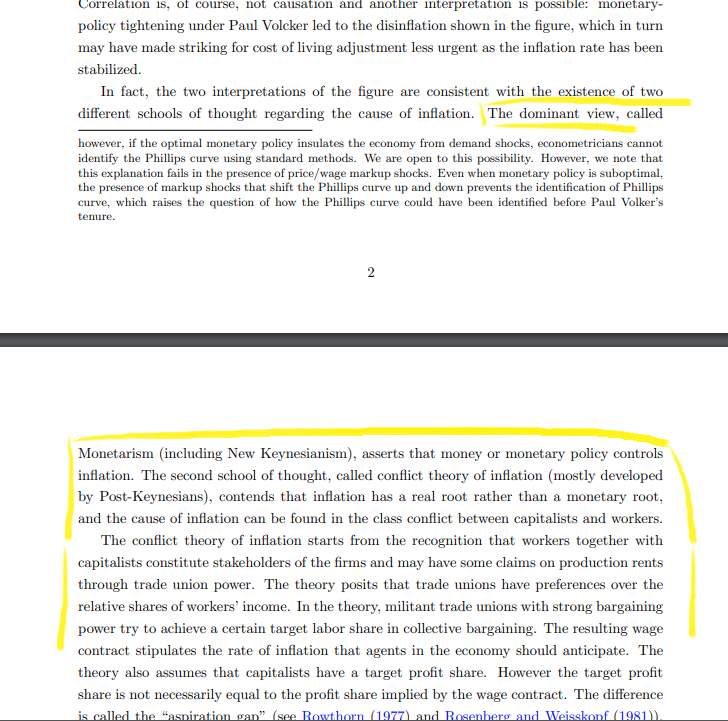

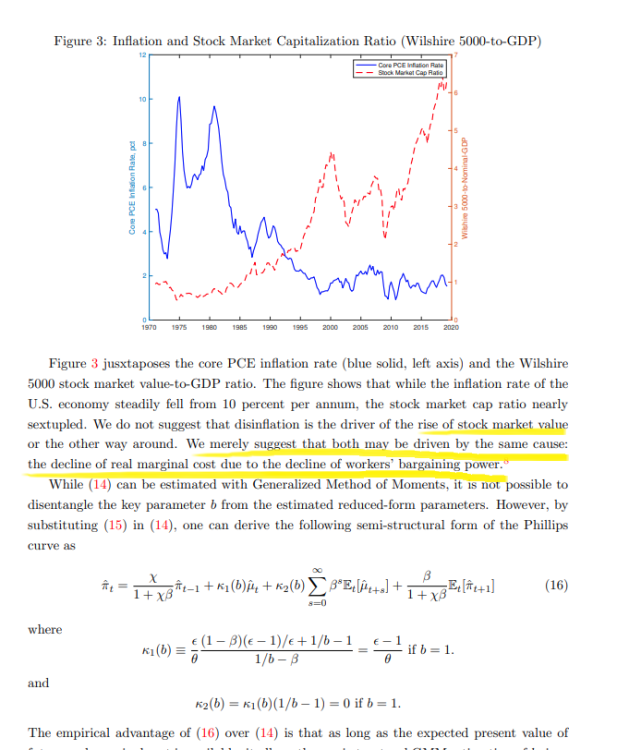

(Just FYI, and apologies for spamming this thread). The Fed has released a paper last week (linked above), which asserts that mainstream economics theories of inflation are incorrect, and that the competing heterodox theories of inflation are correct. The Fed just shot Milton Freidman's Monetarism in the face with a shotgun.

-

Money and Finance

Here is a Modern Monetary Theory (MMT) founder's response to the Fed paper release, for folks interested in how political monetary economy fights affect gov policy over the long term: https://bilbo.economicoutlook.net/blog/?p=49871

-

Money and Finance

ICYMI: The Federal Reserve has released a paper taking a heterodox econ position which refutes the argument made by Monetarists (Freidman) about inflation. Inflation is not always and everywhere a monetary phenomenon. Note that the source of this argument is classical Marxism, which is one of the foundations of heterodox econ (power & class based analysis). https://www.federalreserve.gov/econres/feds/files/2022028pap.pdf

-

Money and Finance

Note that all currencies are digital (USD, EUR, etc), I'm assuming you are asking about crypto. In Mainstream econ, money is a numeraire, which means that it's not a commodity like gold or corn, but rather a token with no consumption or investment use, that is agreed upon as an instrument for conducting all exchange and is fixed in supply (generally by the gov). Folks in the crypto space tried to create the numeraire (a ledger where a token for exchange can exist and bank or gov money is peripheral, rather than the other way around). Except that BTC, for example, has a real input requirement in order to exist (energy). If crypto had no input requirement, it simply existed like a phantom, then it would have the properties of a numeraire. There are lots of interesting perspectives on crypto, many conflicting one another, which makes it a very large topic. One of the best places to start on the topic would be Desan, because coinage and crypto are similar in that the quantities are [generally] fixed, and we have thousands of years of data on coinage economic systems. Crypto addresses many of the problems identified with coinage: [nearly] infinite divisibility, no loss through wear, and it cannot be diluted [recoined], these are common examples of issues people bring up related to coinage. Because metal content in coinage in early UK was usually fixed compared to the continent, as the crown made explicit their support for creditors (owners of real wealth and holders of coin). The population generally never owned any coinage and it was not used in exchange where the price of goods and services required breaking the coins into pieces so small that they were easy to lose or be destroyed quickly through use. Typically instead of using coinage, simple IOUs were arranged within local communities, based in the unit of account (coinage). Coinage was used mostly for conducting large trade, often long distance trade. Given a growing population, the purchasing power of a fixed stock of coinage had a tendency to rise, which led to hoarding and outflows from Britain toward the continent, where it was regularly recoined and diluted by reducing the amount of metal per coin in order to create more coins for circulation at a value specified by the state. If the value of the metal in the coins was worth more somewhere else due to a redenomination (dilution), people would melt coins down for the metal and take it there, leaving the domestic population without any coinage for settling IOUs or paying taxes. This lead to compeitive redonominations between states who needed coinage to make payments related to war. When the quantity of coinage in the UK economy fell, it reduced economic activity and the outcome was a great deal of innovation in finance in Britain between the crown and creditors facing shortages of metal and war demands, such as gov borrowing, tally sticks, and later bank notes. The holders of coin in Medieval Britain successfully fought against dilution in order to maintain their own power to command real resources. The crown had an opposite interest in ensuring the real resources it wanted or needed could be acquired. When the value of coin was too high, the crown would benefit by ordering that only newly minted money was valid and require all old coins be brought to the mint for recoining (making them 'current'). By creating more coins (reducing weight or adding other metal) than what was brought to them, the crown could create tokens for themselves for making payments. The gov did not have to source the metal, as coining was a monopoly of the crown, people dug it up or collected coins and brought it to the mint. At play here is a dynamic between a state, which needs things and is the sole issuer of money, and holders of those coins, who do not have legal authority to command resources like the crown does, instead they use the money issued by the state. Diluting and issuing coinage was a source of income for the crown (seigniorage) and a means to correct imbalances between the need for coin to conduct exchange, a growing population, prices, and a fixed supply of metal. If crypto is adopted, like any foreign currency outside control of the state, it means that state no longer has to power to fund itself through money issuance, and in many respects can be summarized as a removal of state sovereignty: the capacity of the state to govern is reduced. Central Bank Digital Currencies (CBDCs) fall into two broad categories: Account-based and Hardware-based tokens. If a CBDC is created in the form of accounts, this means you and I have access to reserve deposits on the Fed ledger, either directly, or via some private provider who organize the interface to the central bank's ledger. This means you can hold cash in an online account at the Fed. Digital cash. A Hardware-based token CBDC is essentially cash on a hardware wallet. You load it just like you put cash in your wallet, and those tokens are Fed liabilities, just like cash. Hardware-based tokens are anonymous, like cash. Account-based CBDCs are just like online banking with the Fed. If cash is eliminated then the Fed can push rates negative, and you can't remove your money from the bank, as cash no longer exists. The idea is that by pushing rates negative, and taking money our of your account every day, it compels people to spend their money. Which is false. The desire to save increases as rates become more negative, such as in Germany.

-

The Russian Conundrum

Edit after finishing the video: The logic of his argument is remarkably empty from a production standpoint: China & Germany (current sources of most global production) don't need current levels of energy if their export market disappears, their factories and machines will be turned off. Meanwhile the US (current destination for most exports) will be heavily reliant on imports to 1) survive in the short term and 2) to onshore productive capacity and build a domestic industrial base for the long term. The US needs those imports (think 'we have no PPE!' during the initial shutdowns). If global trade stops... surplus states are in bargaining positions because their industrial capacity already exists. This was the position of the US following WW2, and its surplus position was the source of bargaining power that led to Bretton Woods in the first place (not of gold or financial claims on others, but of real resources and output capacity). A massive increase in unemployment from a collapse in export markets can be managed by surplus states, they produce everything they need in real terms to sustain their non-working population (they are not reliant on imports). It's largely naive to think that the US's dependence upon imports does not place it in a very vulnerable position, but he doesn't mention this once in the briefing. The biggest benefactor of global trade is the US, which can exchange a currency it creates for real goods & services. But, his presentation is oriented in a way that makes it sound like it's actually the rest of the world that are the biggest benefactors of globalisation, which is false. I would argue he certainly got it right, that the US is in the position to use or withhold its military to extract exports it needs from the rest of the world because some of its military capability is not reliant on imports and it has abundant energy to fuel itself, but that makes us the bad guy from the perspective of the rest of the world. I can't tress this point enough, in the context of this briefing, given how he's arguing that a US with ample energy and no industrial capacity will be in a secure position [because they can use their military & energy to guarantee access to commodities elsewhere in the world]. This secord part in [brackets] that is the unspoken core premise of his briefing's argument is almost a literal restatement of British imperial ideology.

-

The Russian Conundrum

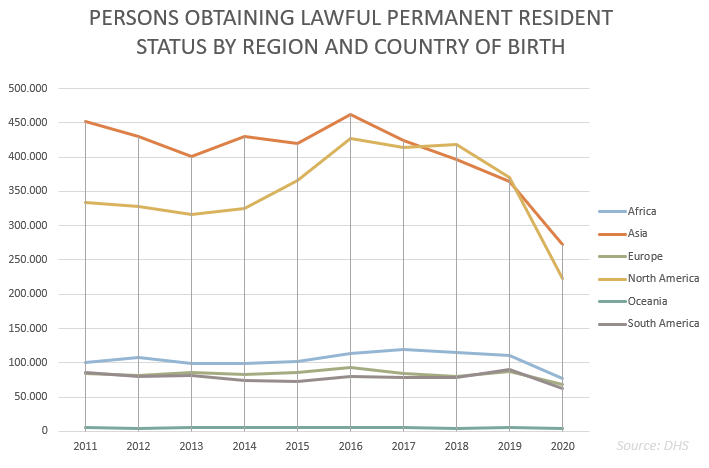

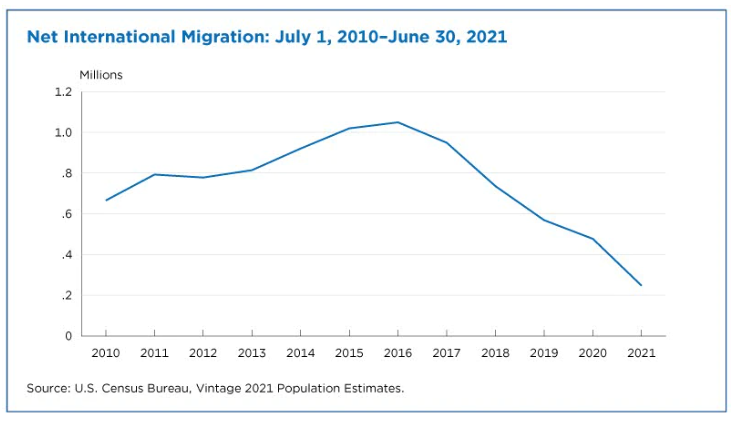

The birth rate in the US and the EU are approximately equal (1.6 vs 1.5), and the birth rate globally is mostly below replacement rate. The only place that doesn't hold is where birth control is not widely available, which is Africa. So in general, assuming developed countries want to continue to provide the same amount of goods and services to a nearly constant population over the next 20 to 50 years, they have to import some workers from Africa and other undeveloped regions. Hence why the EU accepted an influx of migrants from the ME & NA, despite the risks involved. However, immigration to the US is decreasing as well, as incomes & quality of life are no longer sufficiently higher there than in other parts of the so-called 'global south'. That is, prices of critical goods and services are too high to draw migrants or for households to have larger families. All this means is that the total share of income going to households is too low, or conversely, the share of total income going to the financial (banks, NBFIs) and non-financial sector (firms) is too high. This is a well know fact, and one of the reasons why the US recently implemented a subsidy for families with children, an acknowledgement that the current economic system generates an insufficient amount of bargaining power for domestic workers resulting in wages that are too low and overly reliant on credit (and hence interest rate conditions) to finance living. But the statements made that China will implode based on these conditions applies to all developed states, in that context, as all are experiencing the exact same thing: an inability to maintain a workforce that produces the current level of output using just the domestic population. But what's not being discussed is that given stagnating or decreasing population levels in all developed states, fewer total goods and services are required to sustain the population. We don't need more stuff. In that case, the problem isn't one of insufficient goods & services available for households leading to an implosion of the state. The problem is that the total capacity to produce goods and services is larger than the population it serves, which means owners of Capital (machines, factories, and methods of producing things) and owners of the corresponding financial assets (capital) face decreasing prices and lower monetary values for this wealth. This is known as a 'general glut' in economic parlance, one where the 'captains of industry (& their bankers finance)' are desperate for the prices of everything not to collapse.

-

The Russian Conundrum

The poor folks in the audience have no way of verifying anything he's saying. They are forced to assume specialization in economics is valid and trust his statements, when mainstream econ is wrong on most everything. It's painful to watch.

-

The Russian Conundrum

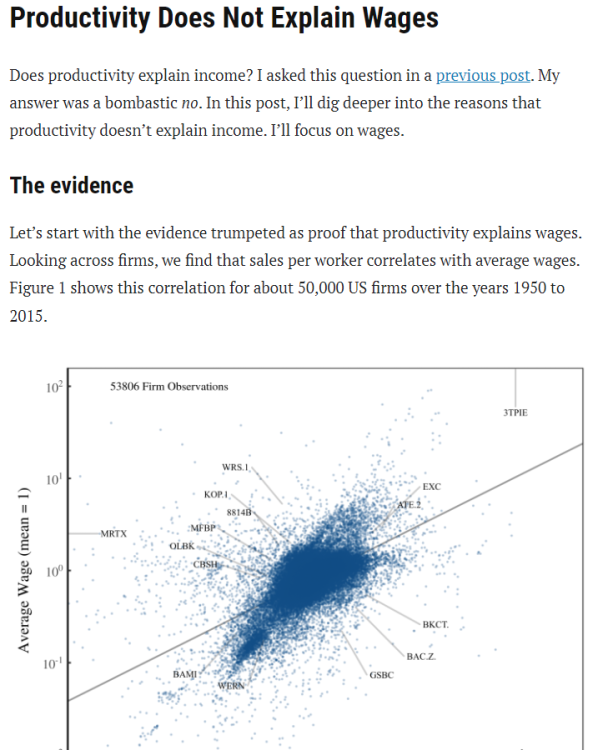

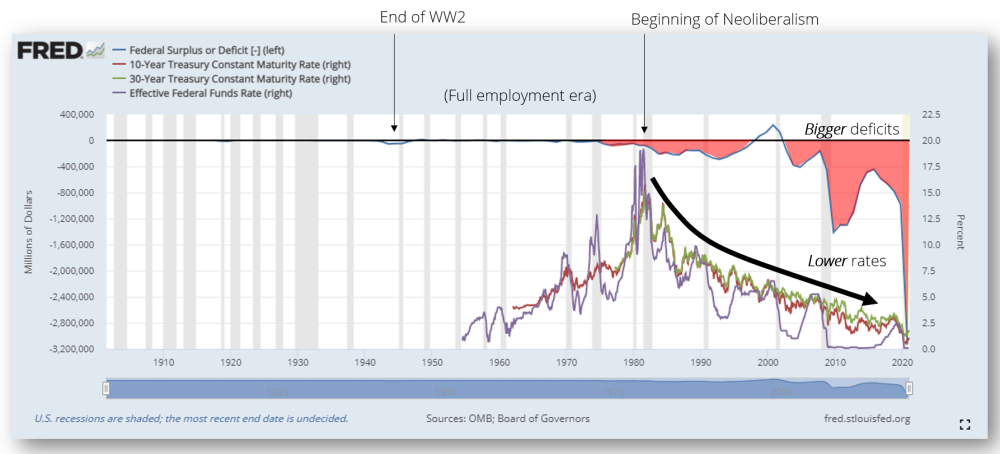

He mentions that interest rates in capital markets are functions of demographics, that 'as people age they will remove "liquidity" from capital markets driving up rates', this is false in a bank money system. Interest rates are a policy variable. It's up to the Fed to choose what rates it wants to target, and that's what everyone pays to borrow from banks and money markets. It doesn't matter what people choose to do with the bank deposits they don't spend. He also seems to think of money as physical tokens--he literally says 'people will put their money to use in the stock market' which is nonsensical. Making purchasing of financial assets in secondary markets doesn't have any effect on future production, its just price speculation, as the firm doesn't receive those funds (retail investors don't have access to private markets where actual investments can be made). More importantly, any financial asset purchased is sold, so the seller holds those deposits and the total amount of money in the system never changes (you can't pull money out of the financial system)--the only way deposits at the commercial bank layer or the central bank layer can leave the system is by repaying debt, or striking it from a ledger. He seems to literally think that when people 'invest' the money is planted in the ground (it's gone!) and then becomes more money and stuff in the future--which is how it's taught in neoclassical models like loanable funds, so... He uses language like 'Capital [money] will shrivel up' to imply the total amount of money in the system will decrease due to demographics (saving increases)--that assumes that banks' lending behaviour is fixed while population changes, and that's false. As an example, about 60% of total money created at any given time comes from mortgage debt, credit cards, and car (large durable goods) loans. Its true that young people take on more of such debt, such that less young people would imply less of this debt and less money in the system for spending, but banks can just as easily come up with other products for older populations to sustain debt levels. And, the gov can always supplement total money by spending directly themselves. Both of these things must occur when savings rates rise, in order to create the money required to meet debt repayment obligations. But, if populations aren't growing anyway, and total consumption is falling, you technically don't need more debt anyway except to sustain unproductive lending that inflated asset prices. TL;DR: the speaker uses an incorrect economic model and draws false conclusions about economic phenonmenon. He says interest rates will rise and money supply contract because of population decreasing, when in fact interest rates are a policy variable and the money supply will continue remain flexible according to bank money creation. He also makes statements about 'US Productivity is higher than China' which is always a red flag, because economists don't actually measure productivity, they measure spot income against average income. So if your income is larger than the average income, you are considered 'productive', but someone earning $5M a year from a bond portfolio doing nothing but sitting on a beach is certainly not 'more productive' than someone working for living, even a pilot, for example. For more info about how the language around 'productivity' is wildly misused and abused, a good recent source for non-economists is a guy called Blair Fix who has lots of articles available on debunking the subject. https://economicsfromthetopdown.com/2019/11/14/productivity-does-not-explain-wages/

-

Money and Finance

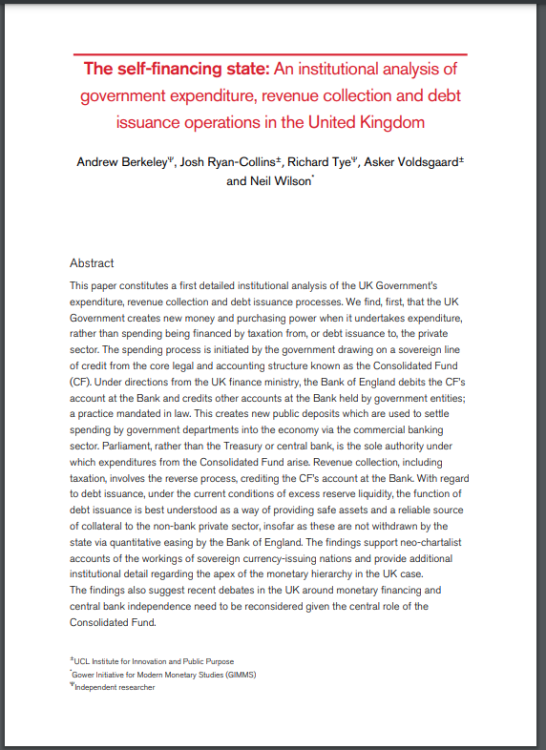

Here is a recent paper from the UK, which is becoming more and more transparent about how monetary operations actually work at their Central Bank. https://www.ucl.ac.uk/bartlett/public-purpose/sites/bartlett_public_purpose/files/the_self-financing_state_an_institutional_analysis_of_government_expenditure_revenue_collection_and_debt_issuance_operations_in_the_united_kingdom.pdf

-

Money and Finance

It looks like you claim that by the Fed increasing reserves through asset purchases that household (or firm) demand for goods and services increases, which implies that by the Fed converting an asset on a banks ledger to reserves, somehow a household (or firm) has a larger balance to spend on goods and services. I think you are confusing commodity money (the money multiplier, and loanable funds) with an actually monetary economy with bank money. In other words, it sounds like you think that a bank receives deposits from the Fed, and that bank then goes out and multiplies up those deposits, and because the Fed 'injected' so many deposits, there will be so much more money in the system for people to spend. Is that what you are saying?

-

Money and Finance

(1) money is debt. I can't stress this point enough. It has nothing to do with good or bad. Debt is required for ANY economic activity to exist. Full stop. The rate of money creation, which means the rate of borrowing, must increase over time given positive population growth and a desire to hold increasing financial savings. This is the basic mechanic of our system. (2) economic systems are not products of natural laws. There is no set of physical laws from which economic systems derive, there are many forms of human organization that anthropologists have researched covering the past 5000 years. I would love to go into more detail on just this topic alone, as there is a vast literature anthropologists have assembled which address this topic in granular detail. Often its rooted in peoples' minds as "hunter gatherer -> agriculture -> cities -> ...", a form of linear progression from savage forager to gentleman owner of private property. This is false. There are many examples of historical societies which oscillated between foraging/hunting and agriculture, or flat hierarchies + no private ownership and systems of private property with complex hierarchies--and they rotated between these forms of organization seasonally. (3) there is no limit to money creation. Banks can always create money if they choose to. The government does not require a private citizen to take on a loan in order for a private bank to create deposits and then earn those deposits or tax them onto the Fed's balance sheet. The Fed is a bank, a gov bank, which can create, literally, an infinite amount of money. Here's Kashkari at the Fed on how much money the gov has access to: (4) Money is created by a contract and it always returns to its source. A loan repaid means that deposits returned to the issuer and the contract was closed, the monetary circuit closed. If a contract is defaulted upon, those deposits entries live on in a bank ledger somewhere for someone else to use to close their loan to a bank--but banks don't earn their profits in terms of bank deposits. This is a very unintuitive idea (of course banks earn bank deposits! that's what I pay them!) and its false. A bank's liabilities are bank deposits, written on their own ledger. When you pay the bank, it deletes those bank deposits. Bank's can't save in terms of their own deposits. They earn profit by destroying liabilities that they created while increasing the contracts they own (assets). The bank is locked in a race to destroy liabilities faster than its assets disappear, which gives them time to create liabilities for themselves on their own balance sheet to buy goods and services. Does that make sense?

-

Money and Finance

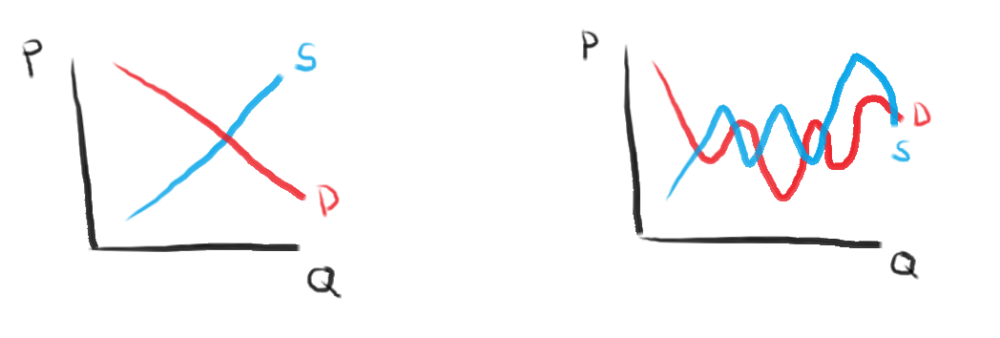

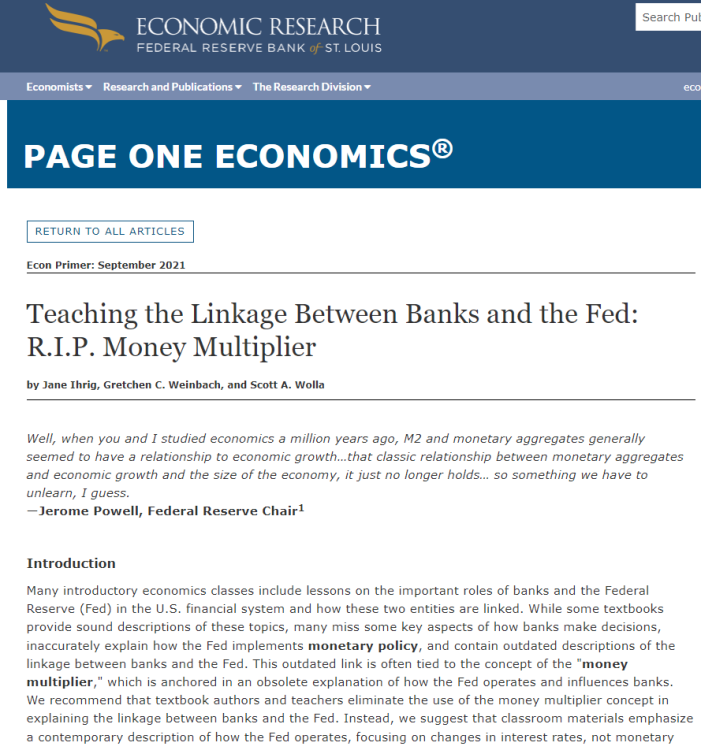

Everything published in mainstream intro economics textbooks is false. This is a literal statement, rather than an embellishment in the pub where one expresses discontent hyperbolically. When Viper is quoting Mankiw, the Fed has published that literally everything in his intro textbook is invalid. I don't know how to ELI5 that because it's a bit like telling someone they are actually the guy in a pod powering robots, and it sounds so absurd people simply can't believe they have been misled to such a degree by massive education institutions. All of the associated policy prescriptions don't have the effects that the textbooks say they have. Many policies actually have opposite outcomes to what's described in textbooks: Balanced Budgets Textbooks: balancing the budget is good for the economy (prevents gov crowding out private investment). Reality: the economy collapses when gov debt levels are too low (when gov saves, private debt must increase to generate assets people want to hold as savings, and this private debt is unstable). Saving Textbooks: saving today will increase output in the future (savings creates investment, treats money like corn, you can plant it and get more in the future) Reality: loans create the deposits people receive and save (investment creates savings, saving today reduces the amount of future output as businesses expand output according to current consumption) Efficient Markets Textbooks: debt has no impact on asset prices, markets allocate most efficiently without regulation Reality: markets are inherently unstable and are created by the state Supply & Demand Textbooks: imagine an 'X', where a upward sloping supply curve crosses a downward sloping demand curve--that is how prices are formed Reality: prices aren't determined by supply and demand, there are almost always multiple intersections between demand & supply curves Interest Rates Textbooks: larger gov deficits lead to increasing interest rates Reality: larger gov deficits lead to decreasing interest rates Textbooks: private investors in bond markets control interest rates on government debt and other securities Reality: interest rates are a policy variable under full control of Fed & Treasury

-

Money and Finance

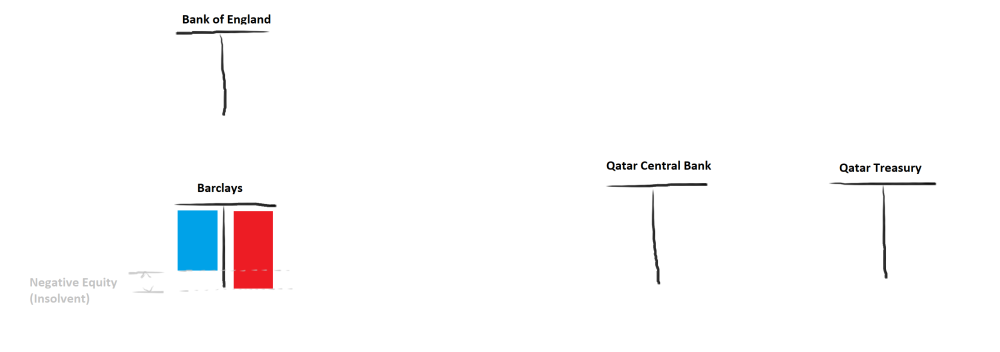

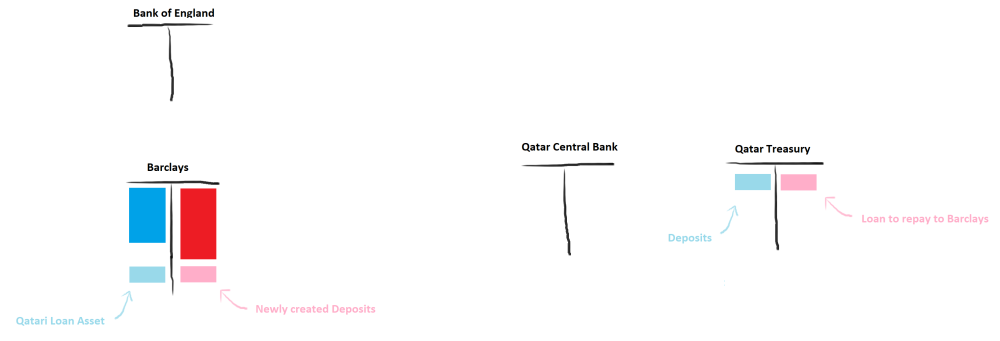

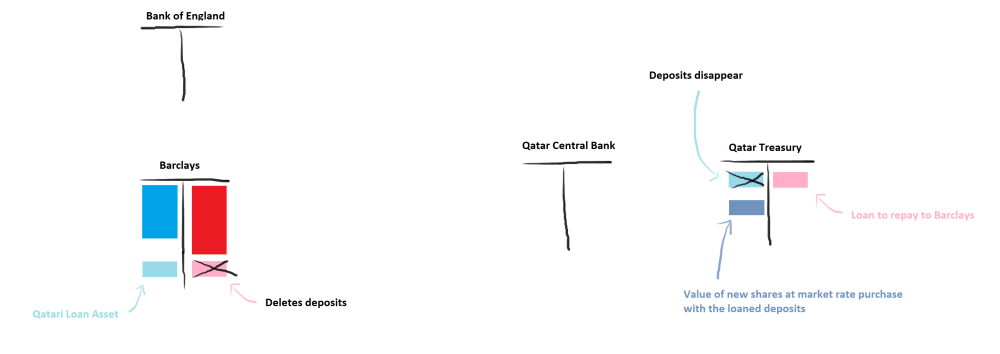

The Barclay's recapitalization loan to Qatar, in terms of balance sheets looks like this. To begin, the value of loans held by Barclays fell as the price of these assets fell during the Global Financial Crisis (GFC). Once the value of Barclay's assets was less than their liabilities, the bank was insolvent. They faced 2 choices: 1) Government takeover, the Bank of England (BoE) and Her Majesty's Treasury (HMT) would purchase Barclays stock with British Pounds created by BoE which would be added to Barclays balance sheet, this would increase the total value of assets and make the bank solvent (A > L), but would also give control of the bank to the British government. 2) Wind down the bank, sell all assets at the current reduced prices, and most equity and bond holders of the bank would realize a financial loss on their investments, all employees would lose employment. Instead of pursuing either option listed above, the bank got creative. Management and Qatari officials agreed to a transaction where Barclays would loan Qatar pounds and Qatar would use those pounds to purchase new equity issuance, total transaction size was approximately 3 billion. First Barclays expands their balance sheet, creating deposits for Qatar Treasury at Barclays bank. Next, Barclays creates approximately 3Bn worth of shares at a price agreed to in contract with the Qatar gov. Barclays deletes the deposits it just created, Qatar's new deposits disappear. The end state, Barclays hold a new loan asset and is therefore no longer insolvent, and Qatar Treasury holds of new issuance of a particular type of Barclays Bank shares. Barclays changed the value of the firm using money it created. Qatar will receive equity dividends from Barclays in the future, which will be used to repay the loan to Barclays. In effect, Barclays created money for itself.

-

Money and Finance

Treasury and Fed have a role in facilitating the smooth operations of a decentralized financial system. Banks are, in effect, state-franchised money creators, and their job is to know where money should be allocated in order to generate the output people will want in the future. The gov, a central entity in space and time, cannot know what everyone everywhere wants and needs. Banks are thus agents of the state--that's what banking licenses are. In order to target a rate of interest in short term lending markets, Treasury and Fed must work together to add or drain reserves from the system such that banks borrow and lend exactly at the targeted rate of interest. This is what monetary policy is. Because the level and rate of change of money in the system is fully decentralized (fully endogenous), the Fed and Treasury have no say over how much debt they should issue, buy, or sell. If banks increase lending and demand more reserve deposits to settle, the Fed must create them, or rates increase above the target. If banks demand less reserve balances Fed must sell treasuries in order to prevent excess reserves pushing the rates below target--and if the Fed doesn't have the treasuries it needs, Treasury must create them. Subsequently, the rate Treasury pays is... determined by the State! Whether it is high or low is not particularly relevant, except that it is effectively 'welfare income' to bond holders who don't produce any output. This is about distributional effects on income and wealth, and about who labours and who doesn't. The gov can always make those payments because they are USD denominated and the Fed controls the USD. Whether the real goods and services exist for people to purchase depends on whether or not the private banks made the correct allocation decisions.

-

Money and Finance

Check it out: reserve deposits pay interest. When we say the interest payments that Treasury has to pay is a burden to future generations, how does that type of thinking apply to Fed reserve deposits paying interest? To be clear, cash doesn't pay interest. But when you put cash into the bank, the bank gets digital reserve deposits from the Fed in place of cash and those pay the Interest on Reserve Balances (IORB) rate. Meanwhile, your bank pays you a rate of zero on your commercial bank deposits. Fed reserve deposits are liabilities of the Fed, and the Fed is a self-funded institution (taxation does not fund the Fed). Where does the Fed get this money for interest payments?

-

Money and Finance

Mankiw's word is incorrect, and his textbook contains many of the errors we are discussing, such as use of the money multiplier (The Fed published that the MM is false, screenshot above) and the loanable funds model (invalidated by revocation of the MM). That is the source of the problem we are in today. Mankiw was pressed on a zoom call discussing Basel banking regulations during COVID for his textbook containing false information, especially the MM and loanable funds, and he was visibly uncomfortable discussing it with the group. I'll see if I can find a copy of that video to share. When money is debt, a party must run a net deficit position that increases in proportion to the population and their desired rate of saving for the system to persist through time (stability). When household and firm incomes are fixed functions of bank lending and banks are net savers, there is only one balance sheet with the capability to borrow regardless of changes to income or asset values: the Fed. This is a critical statement about system dynamics of monetary systems which is neither 'cool' nor 'uncool'. For the system to function and provide the necessary goods and services for highly specialized workers to survive, the gov must provide an increasing deficit position. Otherwise, the system outcomes are 1) extreme inequality and/or 2) extreme financial instability & frequent economic crises. Finally, there is no limit to the amount of reserve deposits the Fed can create. For example, Fed swap lines. There is no limit to amount of liabilities the Fed can create in exchange for liabilities of other central banks. So long as those CB's desire USD, the Fed can create it. Not sure what to take away here. Wikipedia has some great stuff, but this is arguing about salaries within a barter system, when the most recent research has shown that barter systems did not exist to a meaningful extent. And the source link is dead. This article was not well received at the time it was published, and if I recall correctly, VOXEU's editor(s) took sufficient flak they apologized. Regardless, the analysis consists of 'banks don't create money because people trust banks', and it's fitting that the chose Barclays for their example! Private banks create money. A case study is Barclays loan to Qatar for the purchase of Barclay's new share issuance during the GFC. Barclays created a $3Bn loan for Qatar to purchase Barclays shares, the deposit liabilities created by the loan were then deleted, and its total equity increased by the value of the loan asset less fees, which recapitalized the bank and precluded it from state takeover. When we say that 'Barclays did not create money', we need to be specific about how that statement refutes this evidence. Barclays recapitalized itself, with deposits that it created. It created money, and the case that the SFO brought against it was thrown out.

-

Money and Finance

In response to Viperman's assertion that the Gov should run a surplus, given that households want to run a surplus (financial and real savings, like bank deposits in savings account, bonds, firm equity, and real estate) and that firms empirically fund their investment from retained earnings (firms also want to run a surplus), and that banks by definition must run a surplus (a deficit bank is insolvent), and given what we know the Fed and Bank of England have said about money being debt create by banks when they issue loans--who is holding the debt? Not the government (Treasury or Central Bank). Not the households. Not the firms. Not the banks. Not the foreign sector. What's left? There is nothing left. In such a system, where all parties desire to hold a surplus, the economy collapses because there is no money to conduct exchange.

-

Money and Finance

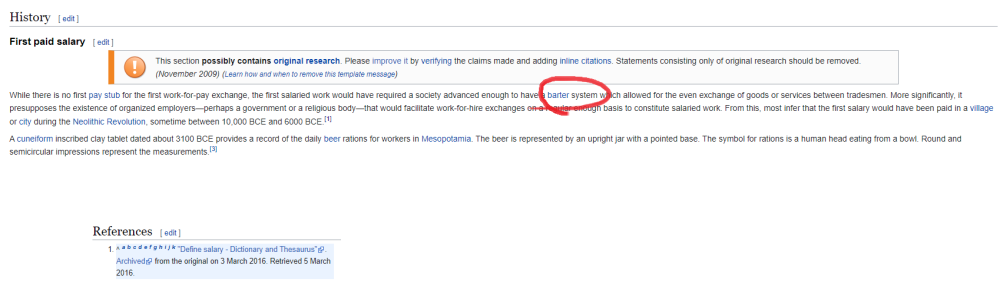

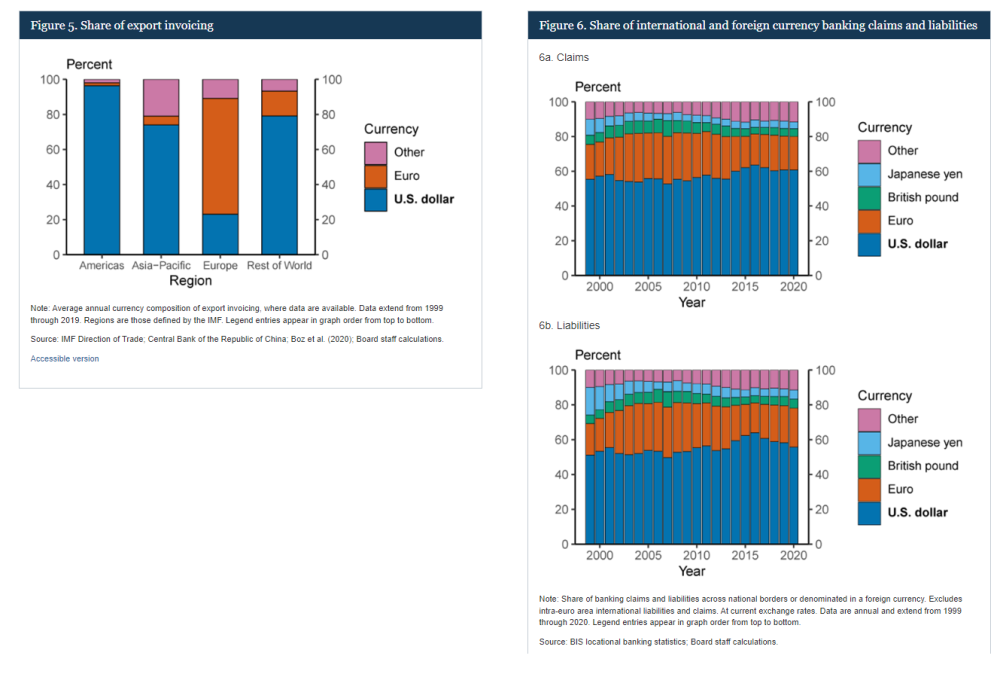

Re: Zimbabwe hyperinflation --> You can a very brief report on Zimbabwe here for folks who aren't familiar with the history of the region: https://clintballinger.com/2020/04/30/airplane-crashes-arent-hyperlandings-notes-on-zimbabwe/ The second most important takeaway from Desan is that the typical description of money as something that is: 1) Medium of Exchange, 2) Store of Value, 3) Unit of Account, is factually incorrect. Money, in short, is a means of organizing human beings through some central authority toward some specific objective, and its role as a means of settlement between third parties was not an intended outcome, originally. The primary reference here is Sumer, or modern day Iraq, and the use of taxation to create waterways for irrigating crops in approximately 4000BC. In exchange for early payment of taxation (barley used to feed workers performing the work and fighters to defend the city) tokens were issued, which were collected at the time of taxation to ensure double payment was not enforced. These coins held value equal to the tax amount in terms of barley, and circulated in peripheral exchange unrelated to the tax or associated irrigation projects. The token which was imprinted with an image of the ruler was not a store of value, medium of exchange, nor a store of value without the ruler or their capacity to enforce the tax imposed. To be blunt, the concept of intrinsic value of commodity money as the basis for an objects moneyness is false. Here is an example of what I am trying to address here in this thread. Viperman is making an assertion of treating the Gov balance sheet like a household balance sheet, and he uses Kotlikoff as a source: If we look at some of Kotlikoff's work, we will notice something: there is no money or banks in the model. Although there is language that agent's hold 'equity or bonds denominated in dollars', the money supply is actually exogenously determined as any amount required by the agents themselves. This means that Kotlikoff is assuming that there is a single money issuing authority which will always create any amount of money tokens required. This is not realistic, first because we know that money is debt and is created by predominantly by private banks (as stated by the Fed and Bank of England), and second because money issuance is not guaranteed (the recent crisis in money markets are empirical facts that money is not always created when demanded). So here Viperman is making assertions about a government's use of money citing an author who does not incorporate bank money in his models, just as an example. Another way of expressing the same idea could be something like: "let's analyze paths of aircraft in an airspace assuming that an aircraft can transit space occupied by mountains without any negative effects" or "lets assume that terrain is always everywhere flat". The rest of the world generally saves in terms of dollars, and requires dollar denominated bank deposits in order to conduct exchange, which we can see here. This puts the US Federal Reserve at the top of the money hierarchy, although the Euro is increasingly used for exchange. The limits to bank-created money is generally collateral, which is to say that regulations (which are not laws!) and finance creativity govern the total supply of private liabilities banks can create. However, there is no limit to the amount of reserve deposits the Fed can create, because they are accounting entries--the real goods and services those dollars can allocate may change if the Fed were to create 'too much' for the 'wrong projects'. In general, however, discussion about the level of deposits is irrelevant an endogenous money system. What we are interested in is real goods and services, real projects to increase future production, current and future quality of life.

-

Money and Finance

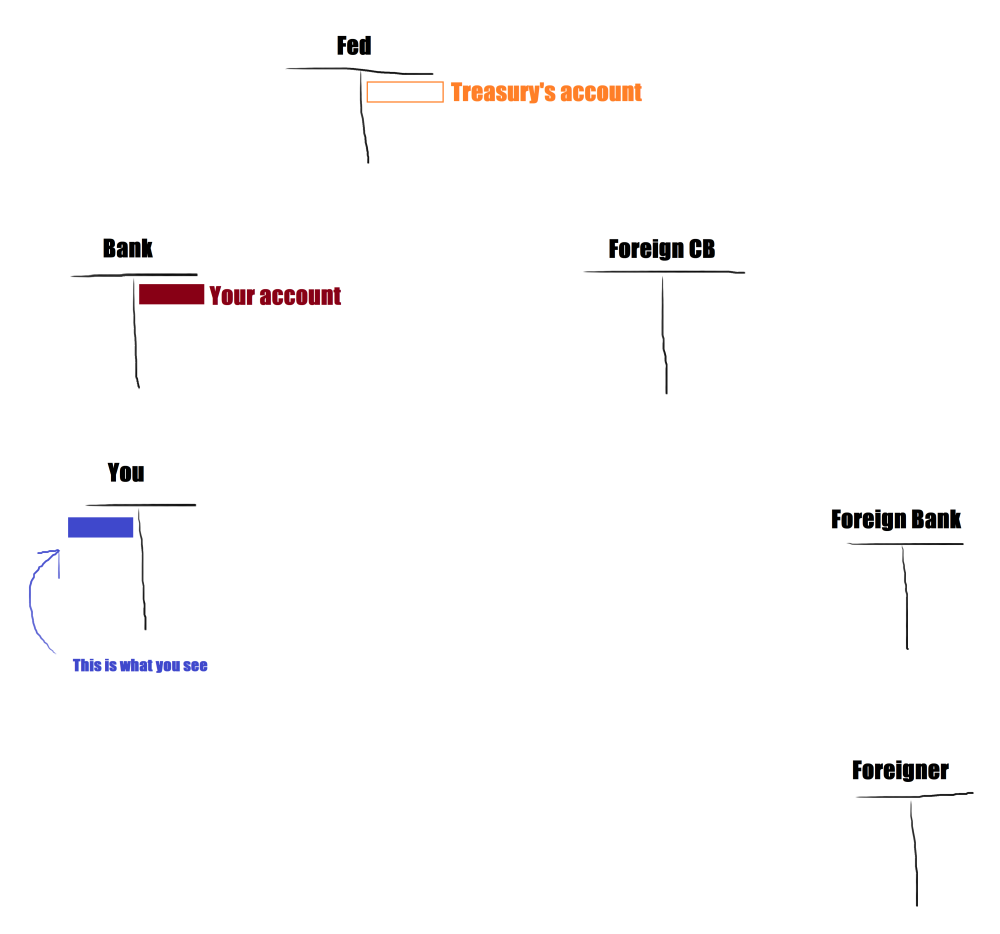

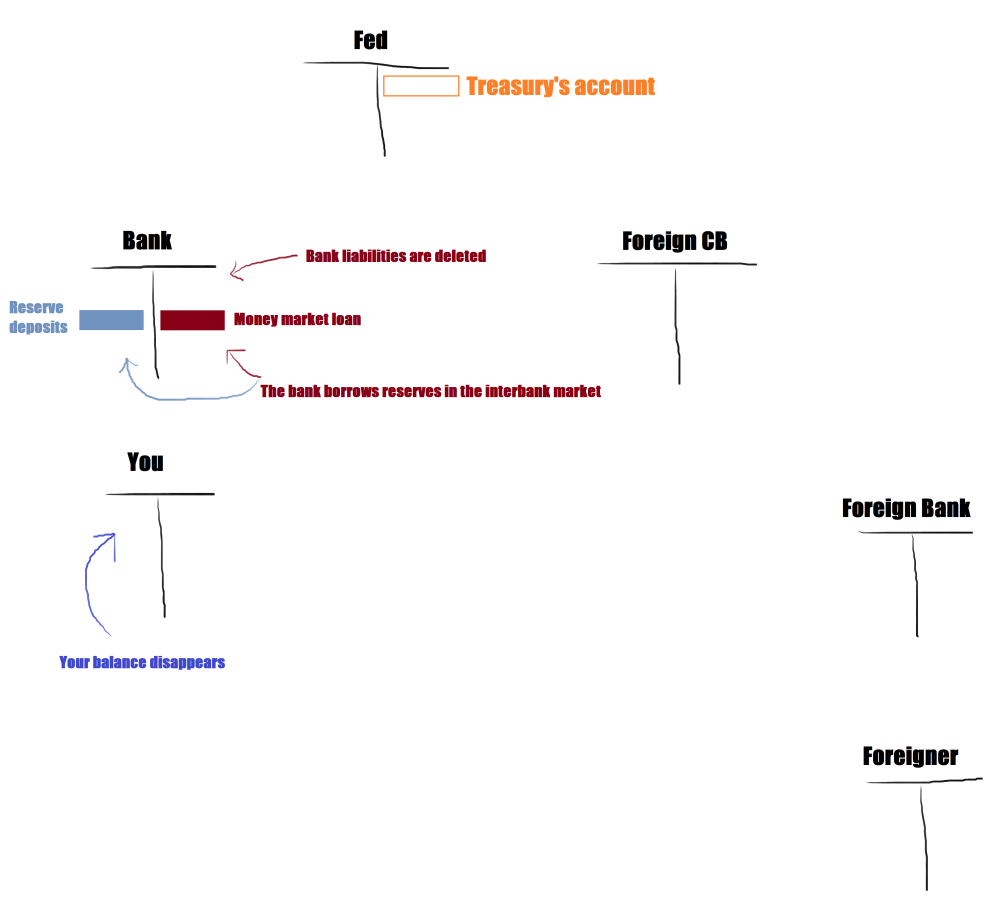

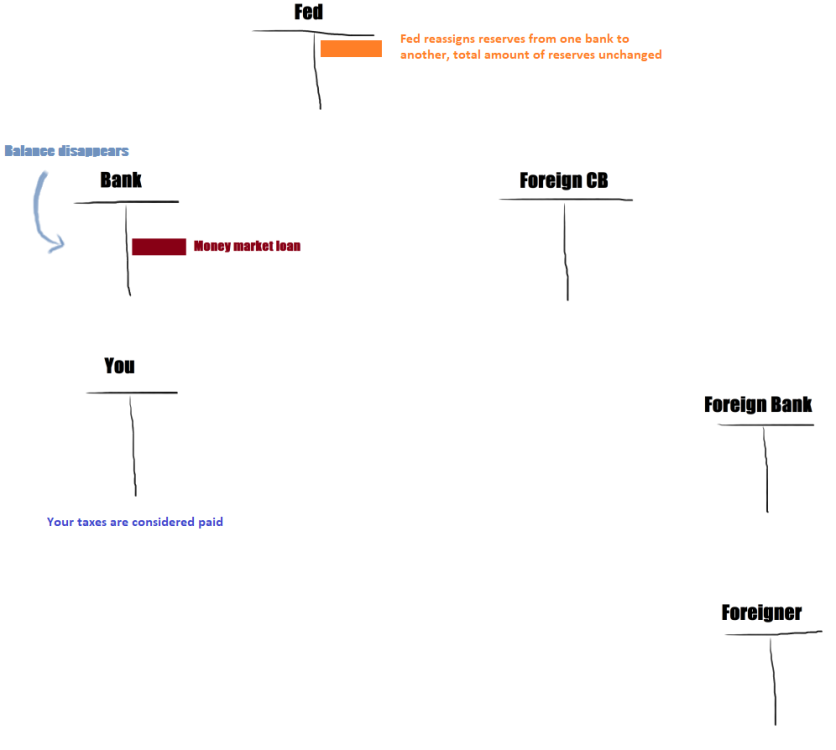

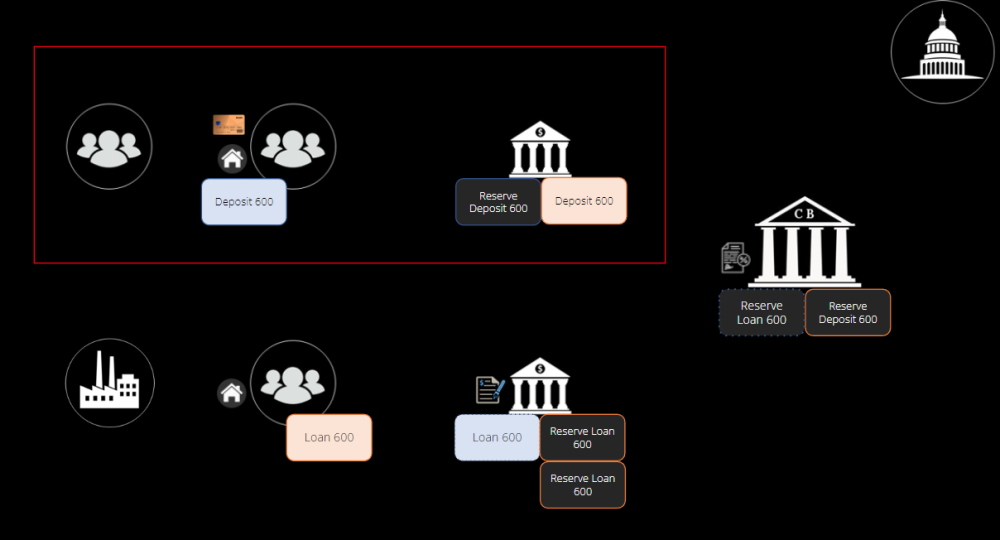

This leads us to our first actual post on money and finance, and we should start by asking why is this a necessary topic. Alluded to above, the theory most people have been taught about money is false, and after a 40 year fight the central banks are acknowledging this fact. This means that the arguments and assertions most people make are often, unknowingly, incorrect. Let's start by covering some useful facts: most large nation states don't have reserve requirements. And, the money supply is not created by banks accepting deposits first and then lending them out. Instead, banks create money when they issue a loan, and no pre-existing deposits are required to issue that loan. The bank creates money when it writes entries on its balance sheet. As such, money is technically two things at the moment it is created by a private bank or money creating entity, such as a non-bank financial intermediary (aka shadow bank): an asset (A) and a liability (L). These two components are bound together by the legal contract which creates them, such as a mortgage loan created by a bank and signed by a borrower. When the liabilities are returned to the contract, the asset and liability are then deleted from the balance sheet of the bank (destroyed). Money pops into and out of existence according to the lending practices of banks and loan repayment. There are multiple kinds of money, globally organized in a hierarchy of importance, for example: $ Federal Reserve Deposits $ Commercial Bank Deposits $ Eurodollar Bank Deposits $ Private contracts When people use language like: "there is insufficient reserves in the system" or "reserve liquidity is too low" they are talking about a specific form of money, Federal Reserve Deposits. These are just like the deposits you and I have in our commercial bank accounts, except that they belong to account holders who bank with the Federal Reserve (checking accounts of the banks at their bank, the Fed)--you and I cannot open reserve accounts at the Fed, we cannot hold reserves in digital form. However, cash is essentially a reserve deposit in physical form, and we can hold cash. Similarly, we can open accounts at the Treasury (https://www.treasurydirect.gov/) to purchase US Gov securities directly, which is very similar to being an account holder at the Fed (you become, essentially, an account holder at the Treasury which is an account holder at the Fed). The hierarchy of money is a outcome of historical circumstance. A great source covering this topic in detail is this book here: https://www.amazon.com/Battle-Bretton-Woods-Relations-University/dp/0691162379/ref=sr_1_1?crid=12M70BIUIWIBJ&keywords=battle+of+bretton+woods&qid=1652974414&sprefix=battle+of+bretton+woods%2Caps%2C160&sr=8-1 In short, the US deposed the UK through clever finance and replaced the Pound Sterling with the US Dollar as the primary means of all financial settlement in the early 1940's. If you had to read one source in this thread, The Battle of Bretton Woods would likely be the most applicable to military history and education and is the easiest to read. We visualize the hierarchy very simply with a set of balance sheets corresponding to each bank, and their account holders. Here you can see your account at your bank, which is simply an entry on that bank's balance sheet. Similarly, your bank is account holder at the Fed, as are foreign central banks and some foreign banks. What you see in your account is just the bank's liabilities they have assigned to you. These numbers do not represent physical objects or cash at the bank, or any bank, they are just numbers in the liability side of the bank's ledger. For matters about the government's debt level, taxation and government borrowing, we are interested in the account at the Fed for the Treasury, called the Treasury General Account (TGA). You can see the balance in the TGA at the Fed, you can always see the TGA at the Fed online, pirctured here below: When you pay taxes, bank deposits in your account are deleted from your bank's ledger. And, reserve deposits in your bank's account at the Fed are also deleted. The Fed then marks up the TGA. Subsequently, taxation removes reserve deposits and commercial bank deposits from the system. We can say that taxation reduces liquidity, as it reduces the total amount of 'money' that people can use for payments from the financial system and places it in the TGA. Running a gov surplus thus reduces the capacity of the private sector to make payments, which increases fragility. Running through the balance sheets of a tax payment: your bank deletes its liabilities it assigned to your account, and your balance disappears from your account. The bank then borrows reserve deposits in the interbank market which it will use to complete your desired payment to Treasury. -------------------------------------------------------------------------------------------

-

Money and Finance

I'd like to break this out into its own thread on money, finance, and government spending, and so it's being placed here in the bar. Before any discussion, here are some sources to share, for folks who want to do start their own research and verify claims. If we want to understand money, what it is and always has been, a good place to start is coinage (silver, gold and other commodity money): https://www.amazon.com/Making-Money-Currency-Coming-Capitalism/dp/0198709579 Desan shares great examples from the origin of market capitalism (the UK), for example how the end of the Roman empire lead the inhabitants of the British Isles to abandon coinage in 400AD for nearly 800 years, and why those coins ended up buried in the ground during that time. Next is the modern financial system. The best and fastest way to get an intro to this topic is from a guy named Perry Mehrling and his open course, self-paced and free, located here (and also on youtube): https://www.coursera.org/learn/money-banking Mehrling's lectures don't require any background in math or economics, and are all geared towards how money markets actually work. The best source for amending your current knowledge of economics, assuming you completed an Econ 101 course in college and that is your basis for understanding the economy, is a guy named Steve Keen, who is most famous for his '95 Phd thesis which included a model that mathematically described the '08 global financial crisis. In his first book he gets at all the issues with the models you were taught and why they are wrong, with a focus on money and banking: https://www.amazon.com/Debunking-Economics-Digital-Integrated-Dethroned-ebook/dp/B09LQ9JJYP/ref=sr_1_2?keywords=debunking+economics&qid=1652869744&sprefix=debunking+ec%2Caps%2C157&sr=8-2 Here is an animated powerpoint presentation someone on Twitter made that covers money creation and basic operations of the US financial system, for folks who want quick and dirty gouge without reading hundreds of pages on banking & finance. Download as powerpoint (.ppt), but please check the file for viruses before running (as with any download off the internet!). https://docs.google.com/presentation/d/1gJX9qx-g7VMdn-rG3fNHsavGmBrfTQmd/edit#slide=id.p24 And here is an even shorter intro to money creation from the Bank of England about how money is created (by banks when they issue a loan, and no deposits are required for the bank to issue loans). This was the first admission by a central bank that the theory taught in Economics courses was false, made in 2014. After the admission by the Bank of England, the US Federal Reserve has begun releasing its own documentation detailing how the theory taught by mainstream economics in false, such as: https://research.stlouisfed.org/publications/page1-econ/2021/09/17/teaching-the-linkage-between-banks-and-the-fed-r-i-p-money-multiplier?utm_source=twitter&utm_medium=SM&utm_content=stlouisfed&utm_campaign=7a051d1e-5d0b-4e98-ac43-8f8de89ffb2d

-

The meaning of life and other ill sh!t

AFAIK I can't create a thread (or I'm too old to find the 'create post' button).